Neobanking or digital banking, a disruptive force in the financial sector, continues to reshape the landscape of banking services worldwide in 202. 6Operating exclusively online, neobanks offer a range of financial products and services without the constraints of traditional brick-and-mortar branches.

This article delves into the biggest digital banking opportunities in 2026, from embracing cutting-edge technologies to fostering financial inclusion and social responsibility.

Neobanking Market Overview

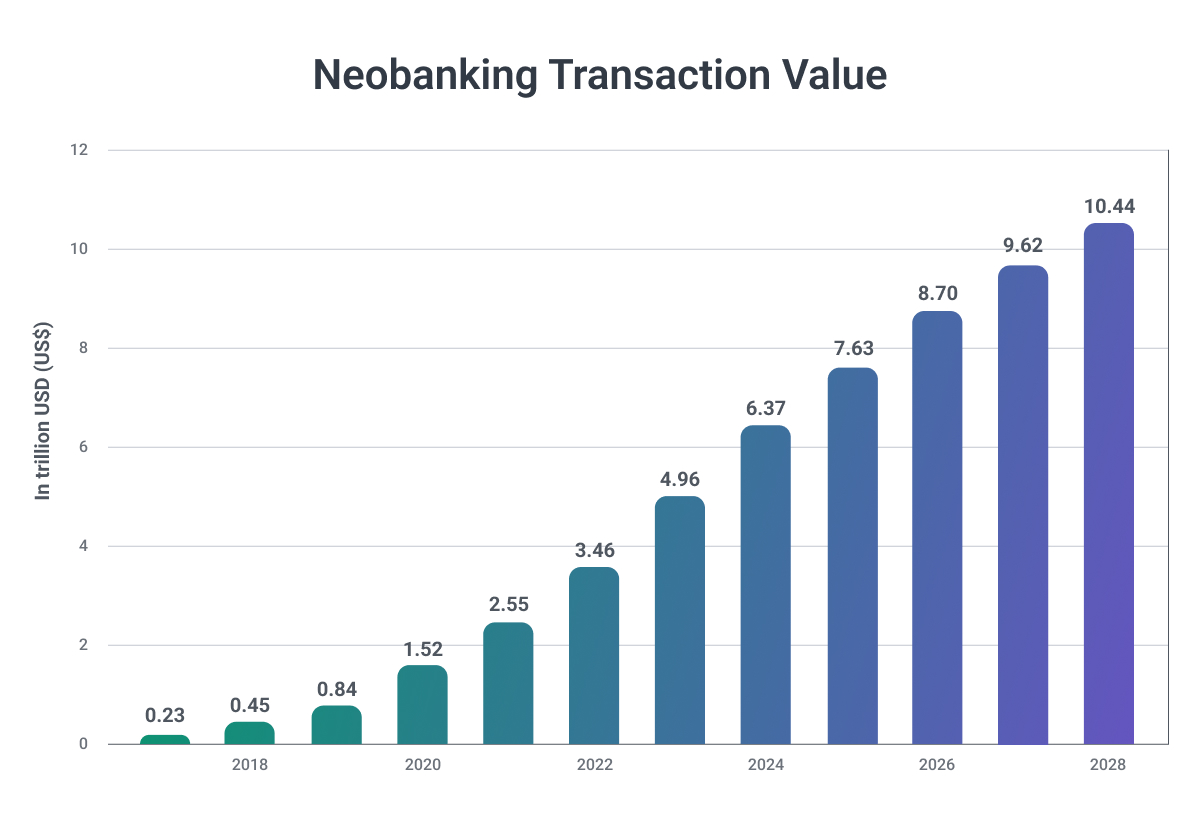

The Neobanking market is poised for significant growth, with transaction values projected to reach $333.4 billion by the end of 2026, rising at a market growth of 47.1% CAGR according to the KBV research report.

The number of Neobanking users worldwide is expected to grow to 386.3 million by 2028, underscoring the rising adoption and opportunities within this innovative financial sector. The growth of neobanks comes from key drivers, including increasing smartphone and internet penetration, demand for better digital banking experiences, and favorable regulatory initiatives.

Leveraging Technology for Personalized Banking

Digital banks disrupted the financial market for their innovative use of technology to deliver highly personalized banking experiences.

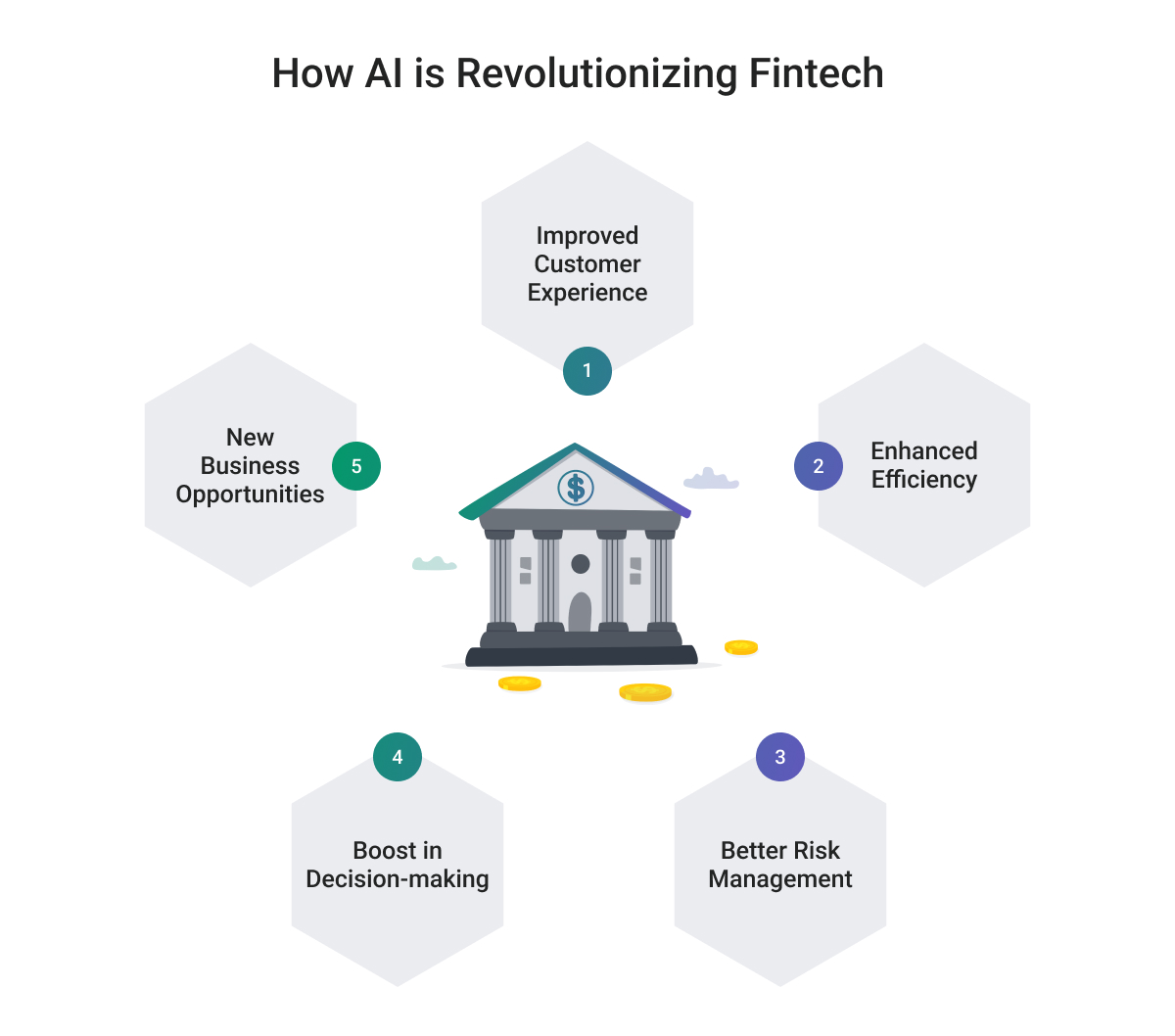

Using advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms in finance are able to analyze customer spending patterns, enabling them to offer tailored budgeting recommendations and financial insights in just a few clicks.

In a short time, digital banks got a vast amount of data that gave them a chance to deeply understand their customer's needs and preferences, thereby enhancing user engagement and satisfaction with their services.

Key Opportunity: AI-driven Personalization

Digital banking platforms can now leverage AI and ML to offer personalized rewards and incentives to their clients, such as cashback on specific spending categories or discounts at preferred merchants, thereby increasing customer loyalty and retention. Here are a few examples of how some of the biggest digital banks are using technology to improve customer experience:

- Automatic savings roundups - Fintechs like Moneybox use algorithms to link with customer bank accounts and debit/credit cards and round up purchases to transfer the spare change into investment accounts automatically. This makes saving effortless.

- Instant account openings via eKYC - Leveraging AI-powered electronic know-your-customer (eKYC) checks, neobanks like Nubank allow opening an account and getting a virtual card in minutes instead of days. This improves customer convenience significantly.

- Personal finance insights through PFM - Chime applies data analytics on linked spending information to provide personalized insights for its users into their monthly budgets, top spending categories, subscription charges, and potential savings opportunities. This promotes better financial management.

- Real-time fraud monitoring via ML - Revolut leverages machine learning on millions of transactions to instantly flag irregularities and detect actual fraud vs false positives with over 90% accuracy, enabling market-leading card security.

- In-app human agents via NLP - Through natural language understanding, UK neobank Starling can interpret customer queries and direct them to human agents over in-app chat for specialist advice in real time for a personalized touch.

So, in essence, next-generation technologies in digital banking can enhance security, convenience, and personalization and even add a human touch for a superior digital banking experience.

Collaboration between software development providers that offer digital banking solutions and fintechs will be the backbone of these advancements in 2026. With all these innovations, expanding the possibilities for reimagining digital banking around user needs will become easier.

Embracing Cryptocurrencies and Blockchain Technology

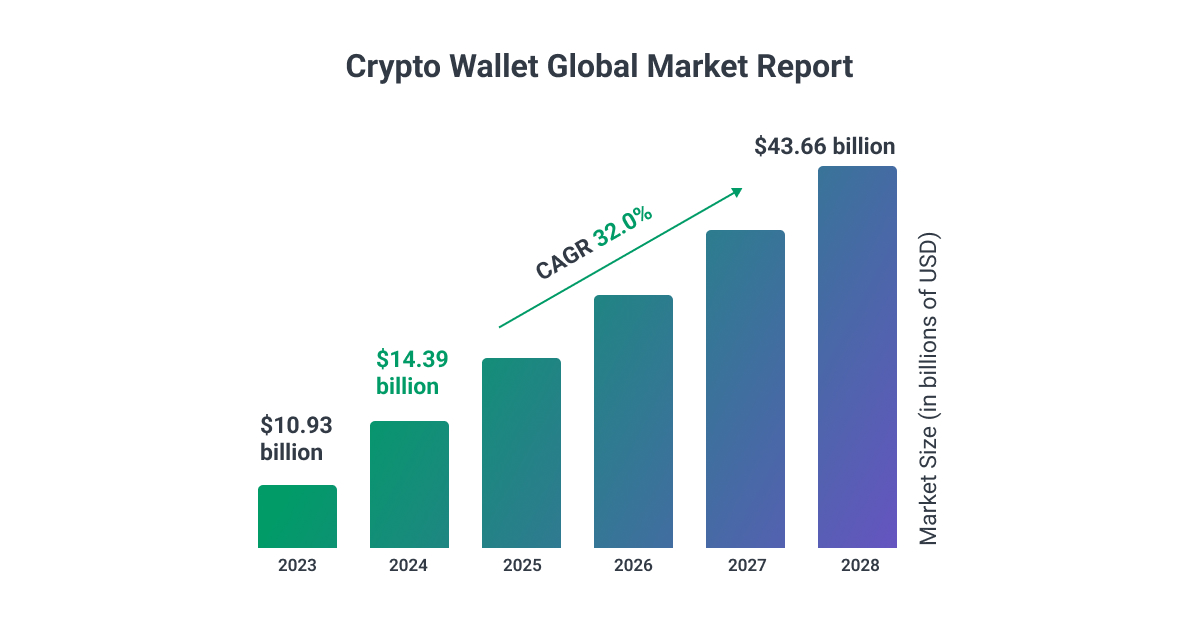

Some digital banks are at the forefront of the cryptocurrency revolution, allowing customers to manage their digital assets directly within their banking app. By embracing cryptocurrencies and blockchain technology, digital banks offer specific solutions that allow customers to access alternative financial instruments and investment opportunities.

The decision to move towards digital currencies reflects the evolving nature of finance and movements of the world cryptocurrency market and positions digital banks as pioneers in the digital economy. While brick-and-mortar banks are still slowly moving toward the idea of offering crypto services, digital banks can easily fill in that market gap and offer services to interested users.

Key Opportunity: Crypto Integration into Existing Systems

Neobanks can expand their service offerings by integrating additional cryptocurrency features, such as staking, lending, and decentralized finance (DeFi) protocols, catering to the growing demand for digital asset management. Neobanks are embracing cryptocurrencies and blockchain technology in a few key ways, with some recent examples:

- Crypto trading and custody services - Offering users the ability to buy, sell, and hold cryptocurrencies like Bitcoin and Ethereum directly in their banking apps. For example, Keabank is a global neobank that offers a blend of traditional and innovative banking services. Its offerings include SWIFT and SEPA payments, dedicated IBANs, crypto exchange and custody, and foreign exchange services. Additionally, Juno, a US-based Neo-bank, offers full-service USD banking solutions for crypto users.

- Crypto rewards programs - Some neobanks in the UK, like ZELF, give cashback rewards in the form of popular cryptocurrencies like Bitcoin rather than fiat currency to promote crypto adoption.

- Fundraising via crypto token sales - Bitpanda raised $52M through an Initial Exchange Offering, selling exchange tokens to investors in a way similar to cryptocurrency fundraising models as the crypto-first model helps secure capital.

- Decentralized finance (DeFi) applications - Neobanks like Ziglu have started integrating DeFi apps to allow users to earn yields up to 5% on crypto and fiat savings through decentralized protocols rather than via banks.

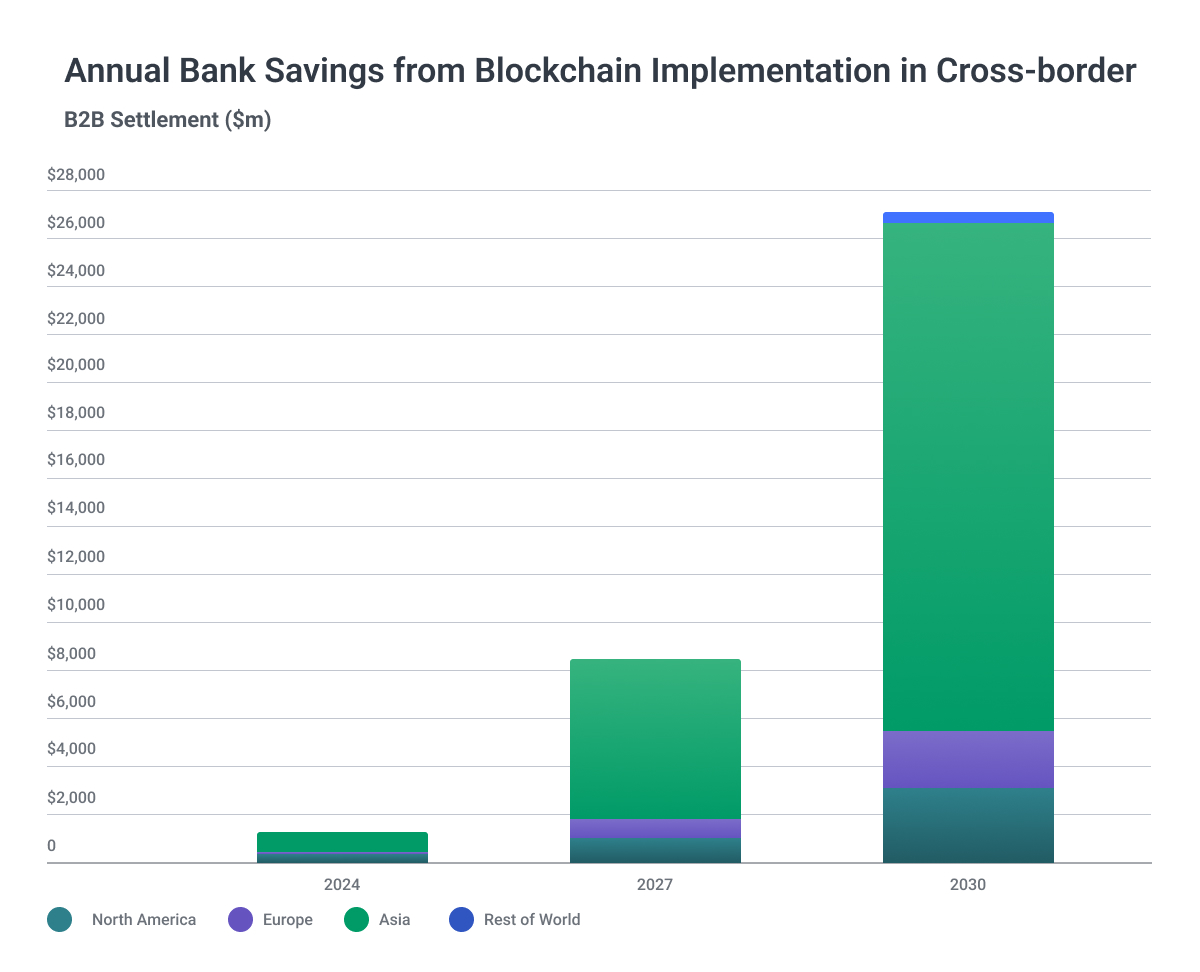

- Blockchain-based money transfers - Using public blockchains as global payment rails for remittances allows faster, cheaper cross-border wire transfers. Neobanks like Wise have already implemented this for mainstream use.

With rising consumer demand for crypto services, integrating crypto/blockchain technology can significantly expand the addressable market for digital banking platforms as more banking activity shifts on-chain. This showcases how digital banks remain at the forefront of financial innovation with their agility and flexibility.

Promoting Social and Environmental Sustainability

Social responsibility is entering all industries, including banking. Digital banking platforms increasingly adopt a socially responsible approach to banking, empowering customers to support green causes they can oversee and learn about directly from their digital banking apps.

By facilitating charitable donations and promoting environmental sustainability initiatives, neobanks align themselves with the values of socially conscious consumers. This commitment to social impact enhances brand reputation but also fosters a new sense of community among customers as they gather around the same cause.

Key Opportunity: Social Impact Partnerships

Digital banks often collaborate with nonprofit organizations and environmental initiatives to offer exclusive rewards and incentives tied to charitable contributions, encouraging customers to make a positive difference through their financial transactions.

Here are a few examples of how only digital banks promoted social and environmental sustainability and attracted more users recently:

- Eco-friendly debit cards: Sweden's Doconomy offers a credit card that tracks the CO2 footprint of user purchases and rewards sustainable spending. It offsets 100% of its own operations to be climate-positive.

- Charitable donation programs: UK digital bank Monzo allows users to round up transactions, save unused money in 'Pots', and seamlessly donate funds to over 20 charities from the banking app.

- Partnering with environmental causes: An Australian neobank called 86400 plants a tree for every new customer who switches in partnership with Greenfleet. This unique value proposition attracts eco-conscious Australians who support reforestation and, through the partnership, acquired a lot of new users.

- Environmental Collaboration: In collaboration with climate engagement provider ecolytiq, sustainable neobank Green-Got has launched their digital green banking app. This partnership offers Green-Got customers a new kind of banking experience, one in which money goes towards a better future as customers discover new ways of taking climate action.

- Sustainability-oriented investment funds: Germany's Tomorrow offers a fully sustainable investment portfolio product that excludes companies engaged in fossil fuels, weapons, and tobacco. It is rated low on ESG metrics to let people bank in line with their values.

- Gamification techniques for social causes: Neobanks like Aspiration from the US motivate people to deposit funds in their "Pay What is Fair" sustainability-focused account using prizes and games. The model has seen good initial traction.

By integrating such purpose-led sustainability initiatives in their business models and product offerings via partnerships, digital banks demonstrate their commitment to enact positive change while meeting the expectations of increasingly socially and environmentally conscious consumers worldwide, especially millennials and Gen Z users.

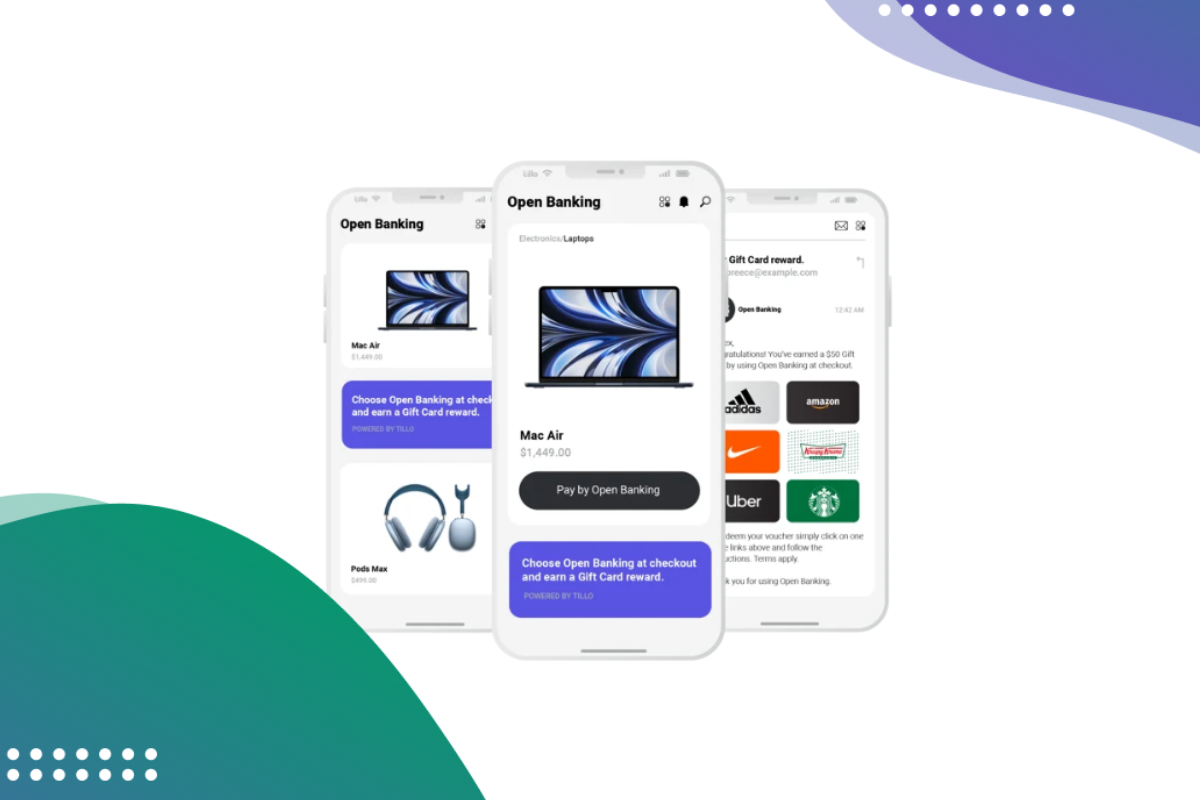

Facilitating Seamless Transactions with Open Banking

Open banking initiatives enable neobanks to seamlessly integrate with third-party financial services, expanding their product offerings and enhancing the overall user experience. The open banking market is predicted to reach $158 billion globally by 2028, according to ResearchAndMarkets, and this interoperability fosters innovation and drives enormous value for customers.

By leveraging open banking APIs, neobanks can provide customers with access to a broader range of financial products, including investment platforms, payment solutions, and a variety of lending services. This interoperability fosters innovation and competition in the financial ecosystem, driving greater customer value.

Key Opportunity: Focus on API-first Development

- Ecosystem Integration: Digital banking platforms can forge strategic partnerships with fintech startups and established financial institutions to create an integrated financial ecosystem, offering customers a comprehensive suite of services tailored to their diverse needs and preferences.

- Account aggregation: Open banking allows neobanks like Revolut to integrate with thousands of banks to aggregate user account data from various institutions in one dashboard to get a complete financial overview.

- Enhanced personal financial management: Bud offers a financial planning experience by leveraging open banking to analyze income, spending patterns, and bills to provide bespoke budgeting and saving tips tailored to each connected bank account.

- Payments initiation: Through open APIs, Small Business neobank Tide integrates payment capabilities that let users easily pay invoices or vendors directly from their account dashboard, enabling seamless money movement.

- Wealth management integrations: Wealth management fintechs like Wealthify can plug their robo-advisory capabilities directly into neobank apps to provide integrated investing experiences like Nuri has done through collaborative APIs.

By mutually sharing data and functionality with external apps via open APIs, neobanks can build a seamlessly connected financial ecosystem that removes friction across multiple banking, payments, and wealth management activities for end users.

Additional opportunities for Neobanks in 2026

- Establishing robust small and medium enterprise (SME) banking solutions. There is significant potential to disrupt traditional business banking by combining neobanking accessibility and ease of use with advanced features tailored for business needs.

- Expanding into emerging markets across Asia, Latin America, and Africa. Many underbanked regions present substantial growth opportunities for neobanks to promote financial inclusion with digital banking adoption. Local partnerships can help drive rapid user acquisition.

- Experimenting with embedded finance models. Collaboration with non-financial brands allows neobanks to integrate banking services into platforms people already use and reach new demographics.

- Exploring opportunities related to digital ID verification and open data access. Emerging capabilities in secure digital identity management and consumer data portability ties into neobanking personalization and ecosystem expansion.

- Developing B2B digital banking-as-a-service offerings. With their modern tech stacks, neobanks can monetize their infrastructure by offering white-label solutions. This allows traditional banks and non-banks to launch digital experiences quickly.

Embracing the Change

Digital banking represents a digital revolution driven by the increasing adoption of online financial services worldwide. By embracing leading technologies and continuous innovation, neobanks are poised for significant growth over the next years as more customers seek mobile-first, highly personalized banking experiences.

Key opportunities for neobanks in 2026 and beyond include expanding AI-driven hyper-personalization features by leveraging larger datasets. Integrating cryptocurrency trading and decentralized finance protocols provides exposure to rapidly growing digital asset markets.

Sustainability and social impact initiatives can attract digitally-savvy consumers. And leveraging open banking enables the creation a marketplace of connected financial apps tailored to all aspects of an individual's financial life.

Additionally, offering robust solutions for SMEs, entering developing markets with large unbanked populations, exploring embedded finance partnerships, developing neobanking-as-a-service platforms, and capitalizing on emerging digital ID trends represent immense opportunities for long-term business growth.

Final Word

By embodying innovation, individual user customization and control, global accessibility to modern financial services, and product expansion through connected platforms, neobanks are poised to achieve significant market share gains over the next five years.

They have only begun to disrupt the multi-trillion dollar market long dominated by slow-moving incumbents strained to provide the experiences that 21st-century consumers and businesses expect.

As digital banks continue to grow and scale globally, with the right fintech software development partners, they have the opportunity to transform finance for billions by making personalized, socially empowering tools available at everyone's fingertips - truly democratizing access to financial services.

We are at the cusp of a new era of digital banking, and neobanks remain firmly at the vanguard, shaping a more inclusive financial future.