While the definition of expense management is the process of planning for, paying, tracking, reporting, and reimbursing business expenses, modern solutions encompass so much more. This includes software solutions and platforms that automate the expense reporting and approval process, enabling companies to have better control over their spending.

As businesses worldwide grapple with evolving work patterns, inflation pressures, and increasing demands for automation, the technology that powers expense management solutions has never been more critical.

At Softjourn, we've spent over 13 years partnering with industry leaders in expense management - from established platforms like PEX (our partner since 2012) to emerging fintech innovators. Through dozens of successful projects spanning mobile app development, AI automation, blockchain integration, cloud migrations, and advanced analytics solutions, we've gained unique insights into where this industry is headed.

Our perspective comes not just from building solutions, but from working directly with the decision-makers who shape this market. For this comprehensive forecast, we interviewed executives from major expense management platforms, analyzed implementation data from our extensive project portfolio, and conducted thorough market research to identify the trends that will define 2025.

What we've discovered reveals an industry undergoing fundamental transformation. While expense management has traditionally focused on the process of planning, paying, tracking, reporting, and reimbursing business expenses, modern solutions now encompass far more sophisticated capabilities. Today's platforms leverage artificial intelligence for fraud detection, provide real-time spending analytics, offer automated approval workflows, and integrate seamlessly with global payment systems - capabilities that were mere concepts just a few years ago.

Predictions for Expense Management Technology and Trends for 2025

Looking ahead to 2025, we will see significant advancements in the T&E expense management industry - from the widespread rise of mobile apps and wireless solutions to the adoption of expense management technologies such as AI, Blockchain, and predictive analytics, that will take the industry by storm.

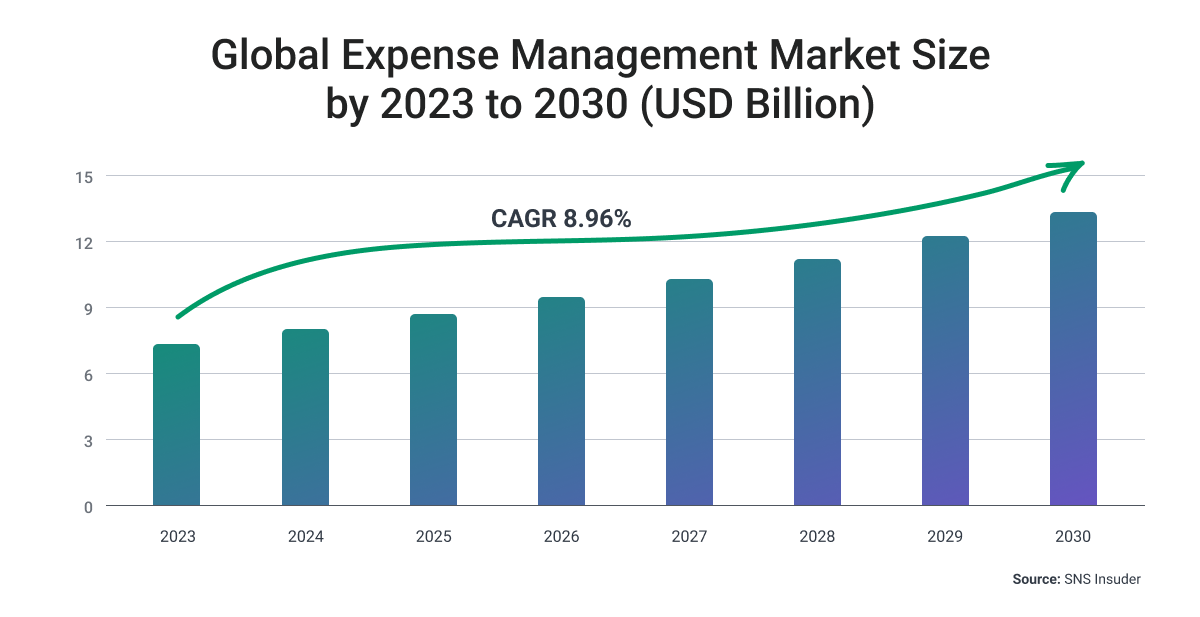

Expense Management Technology Will Drive the Market

The global expense management market is poised for substantial growth. According to SNS Insider, the demand for the market is expected to reach $13.15 billion by 2030, reflecting the increasing e-adoption of advanced expense management solutions across various industries.1 For expense management providers to stay competitive, they will need to adopt technology and features that are in demand for their clients.

Inflation Predictions and T&E Budgets in 2025

As companies plan for 2025, inflation continues to play a significant role in shaping travel and expense (T&E) budgets. Christopher Juneau, Head of SAP Concur Product Marketing, explains:

"Inflation drove higher spending beginning in 2023, resulting in fewer trips in 2024. As inflation slows, many leaders are likely to expect that their T&E budget—even if flat year over year—will go further in 2025."

This dynamic creates an opportunity for businesses to reassess their expense management strategies. With inflation easing, organizations can potentially optimize their budgets, enabling more frequent business travel or investment in enhanced expense management solutions. However, balancing cost control and employee needs will remain critical for growth-focused leaders.

Top 7 Expense Management Industry Trends in 2025

1. The Rise of Mobile Apps

One of the most notable trends in expense management is the increasing mean of reliance on mobile apps for reimbursement proceedings. In today's demand-driven business environment, finance teams and employees are turning to mobile apps - like Emburse, PEX, Expensify, Zoho, and Center - for managing their T&E expenses on the go.

With the increasing prevalence of remote work, mobile expense management has become crucial. So much so that cell phone penetration has surpassed 90 percent and is likely closer to 100 percent among working professionals.2 Mobile apps make it convenient for employees to capture receipts on the go and submit expenses from anywhere.

According to a survey by Certify, mobile apps accounted for over 50% of expense report submissions, a significant increase from previous years.3 Automation tools, namely, expense tracking software and mobile apps, help streamline expense reporting, reduce errors, and save time for both employees and finance teams in the reimbursement process.

The future of expense management is unequivocally centered around mobile. As more businesses and employees embrace remote work and flexible schedules, the use of expense management apps will continue to rise. By the market estimation of 2025, 75% of businesses will primarily use T&E mobile expense management apps to track and report expenses.3

2. AI and Machine Learning to Handle Management Processes

No longer are businesses manually inputting data into Excel sheets; automation and artificial intelligence have transformed expense management. AI-powered tools can scan receipts, categorize expenses, and even detect policy violations, saving time and reducing errors. This not only streamlines the expense reporting process but also enhances compliance.

Omar Qari, Head of Corporate Strategy and Business Development at Emburse, shared with Softjourn, “We expect that the smart expense management players will differentiate themselves with increased automation as well as AI and machine learning capabilities, which will give them the competitive edge in today's turbulent market.”

On the other hand, Jen Moyse, Senior Director of Product at TripIt, feels that most expense management users will hold a healthy skepticism of generative AI for travel in 2025:

"The 2024 SAP Concur Global Business Travel Survey found that 95% of business travelers would consider using AI-powered automation to support their tasks. But given how rapidly things have accelerated with increasing AI adoption across business functions and massive volumes of users on tools like ChatGPT, travelers will still hesitate to let go of full control, and instead will approach AI tools through a cautiously experimental lens.

AI will be seen as a ‘handy assistant’ used to source recommendations, pinpoint trends, and identify expense anomalies, but users will not yet be comfortable with AI booking travel or submitting an expense report for them.

However, solution providers should not be deterred. This is an opportunity to build trust and strengthen AI offerings, which will ultimately put everyone in a good spot when users—and their employers—are ready to make that leap."

Tools to Manage & Watch Finances: Predictive Analytics

Exciting possibilities lie ahead for predictive analytics in expense management. The integration of predictive analytics will become more prevalent, helping organizations forecast expenses, identify spending patterns, and optimize budgets. For instance, AI may predict when equipment maintenance is needed or when travel costs might increase due to external factors like weather conditions or fuel prices.

Expense data is a goldmine of information for businesses. Companies are increasingly using advanced analytics to generate insights from expense data. This helps in identifying cost-saving opportunities and making informed decisions. Gartner predicts that by 2025, 80% of organizations will use expense analytics tools to drive business value from their expense data.4

3. Sustainable Expense Management

Sustainability is not just a buzzword; it’s a core concern for many businesses and expense management is no exception. Companies are adopting eco-friendly practices from encouraging employees to choose sustainable travel options and expense items, to reducing paper usage and choosing eco-friendly vendors. Sustainable expense management not only reduces the environmental impact but also cuts costs in the long run.

Paperless & Cloud Technology

The days of paper receipts and manual data entry are numbered. Digital receipts, e-invoicing, and other paperless solutions will become the standard. By 2025, it’s projected that 90% of businesses will have eliminated paper-based expense processes, reducing administrative overhead and environmental impact.3

4. Enhanced Employee Experience

Employee experience remains a focal point in expense management. Companies will invest in user-friendly expense management solutions, potentially incorporating gamification elements to encourage responsible spending and compliance with expense policies. According to SAP Concur research, a staggering 95% of business travelers are eager to adopt AI-driven automation for tasks such as visa and documentation support, expense tracking, and identifying sustainable travel options. Meanwhile, 64% of travel managers worldwide are keen to see AI automate at least part of their responsibilities.

Remote Work and Digital Transformation

The COVID-19 pandemic accelerated the adoption of remote work, which in turn, impacted expense management. Companies had to adapt quickly, embracing digital solutions to track expenses in a distributed work environment.

With remote work becoming a more permanent fixture in some organizations, the need for digital and cloud-based expense management tools is likely to continue growing.

Victor Domingos, the CFO of SAP Concur, posits that there will be a rise in return-to-office and hybrid work in 2025, which will increase business travel and, thereby, T&E budgets. He said, "Companies will most likely try to do that without compromising on compliance and sustainability. That is where finance again plays a critical role in having the best possible supplier landscape to guide investments in technology that prioritize compliance and environmental, social, and governance (ESG) considerations."

Charlie Sultan, the President of Concur Travel concurs, saying, “The hybrid work trend will continue into 2025. One result we may see, with more employees returning to offices and more companies looking to hire employees within commuting distance, is a decrease in the number of blended work/leisure trips. However, with more and more millennials making up not just corporate travelers, but also serving in decision-making roles, I expect that companies that built a culture around employee travel flexibility will continue to offer those benefits.”

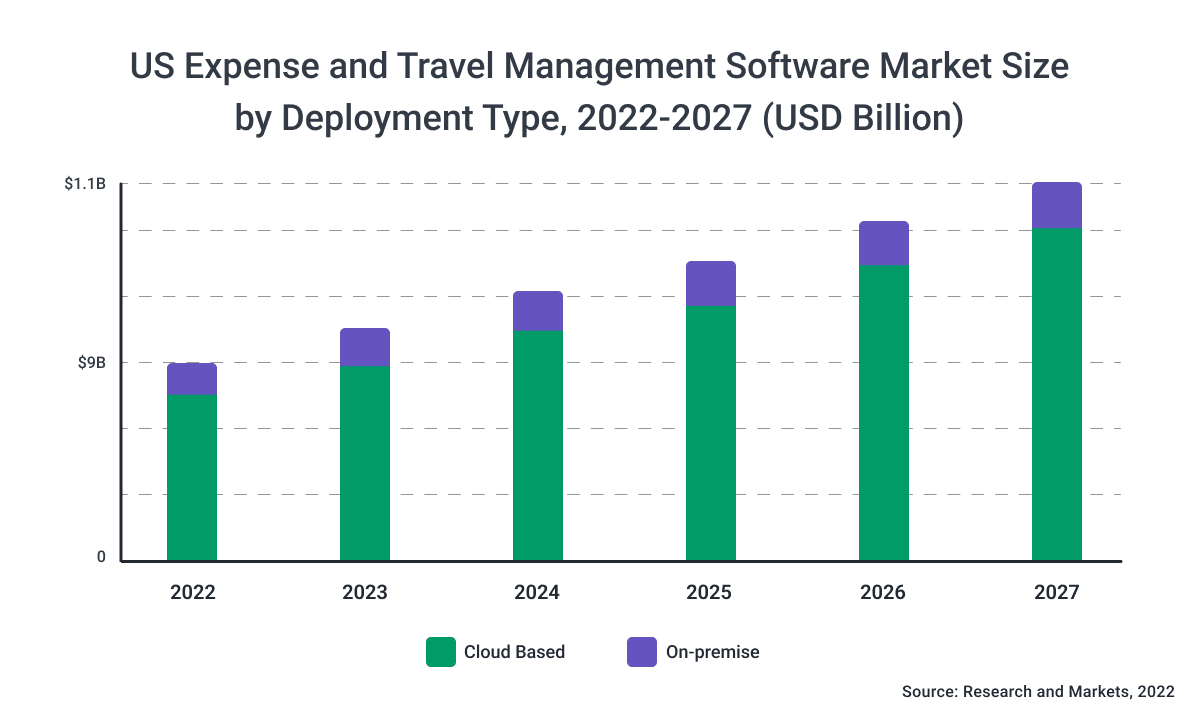

Not only are fewer employees in the office, but most expense management companies will no longer be on-premise and instead are moving to the cloud. The trend to modernize legacy systems and migrate to the cloud will continue growing over time.6

5. Blockchain for Expense Verification

Another innovative expense management technology is the use of blockchain to create secure, transparent, and efficient expense platforms. Blockchain is a distributed ledger system that records transactions in a verifiable and immutable way, without the need for intermediaries or central authorities. A study by PwC suggests that as many as 40% of businesses will adopt blockchain for expense management by 2027.7

Christopher Juneau, the Head of SAP Concur Product Marketing, mentioned the growing emphasis on secure expense management in 2025:

“Investments in technology innovation and security infrastructure will be top priorities. The risks associated with security and privacy incidents will only continue to grow, which means companies are looking for technologies that deliver greater value to customers with lower risk. It is really a balancing act to move fast without disregarding the very important aspects of security and privacy when architecting solutions—internally and for customers.”

Blockchain-based expense platforms can enable smart contracts, digital wallets, and tokenized payments, that can simplify and speed up expense processes, reduce fees and risks, and enhance auditability and accountability. Blockchain-based expense platforms can also enable cross-border and multi-currency transactions, and integrate with other systems and platforms.

Which expense management providers are currently using Blockchain? Even before Bitcoin was introduced, Expensify used blockchain in a novel way. They created a technology called Bedrock to replicate data between databases around the world, enabling fast processing for millions of users at a time.

In 2023, Request launched a new expense app for cryptocurrency, allowing finance and Web3 teams to review, approve, and make mass payouts for expense reimbursements.

6. Global Expansion of Expense Management Solutions

As businesses expand globally, the need for cross-border expense management solutions will grow. Multi-currency and language support will become standard features in expense management tools.

These features allow employees to submit expenses in their local currency, and the software can automatically detect the currency type and convert the amounts to the business's base currency, helping to reduce the risk of errors and ensure that expenses are tracked accurately.

Projections indicate that by the year 2030, a significant 80% of businesses engaged in international operations will depend on dedicated global expense management solutions to meet their needs.8

Many popular expense management services are already growing their international capabilities; Zoho Expense's advanced auto scan feature reads receipts and creates expense reports in 14 languages9, and software solutions with multiple reporting currency features include Expensya, Tricount, Replicon, and more.

7. Telecom and Wireless Expense Management

The adoption of Telecom Expense Management (TEM) is experiencing significant growth. In fact, TEM is growing at an even faster rate than the global Expense Management market. With an astounding CAGR of 10.2% from 2022 to 2030, the global Telecom Expense Management Market is estimated to reach $6.7 billion by 2030.10

Telecom expense management is a crucial aspect of technology expense management, particularly for businesses with extensive telecom usage. By utilizing telecom expense management tools, companies can monitor and optimize their telecom spend, reducing unnecessary costs and ensuring efficient allocation of resources.

The adoption of wireless expense management solutions is poised to revolutionize how businesses track and manage their wireless expenses, providing greater convenience and efficiency in managing telecom spend.

Key Features for Technology Expense Management Service Providers in 2025

Expense management companies should prioritize providing the following features designed to streamline the expense management processes and enhance cost control:

Business Expense Tracking and Reporting

Effective expense tracking and reporting functionalities enable businesses to gain a comprehensive view of their spending patterns, facilitating informed decision-making and efficient cost management. For companies with large amounts of transactions and reports, all that data can become a strategic asset if managed correctly, and utilizing Elasticsearch or PowerBI is a great way to help clients do so.

Expense Management Automation

Automation in expense management streamlines the approval process, reduces manual intervention, and ensures adherence to expense management policies, improving efficiency and accuracy in expense management.

For example, we helped one of our clients automate employee expense approvals. The managing user can configure a set of rules to the platform for auto-approval or auto-denial of their employees’ submitted expenses.

These rules can be based on the category of the expense, the amount of money, from what source (physical or virtual card, or manually added), and even who it was submitted by (certain people or departments can be automatically approved or denied).

Christopher Juneau, the Head of SAP Concur Product Marketing, said, "Finance teams and travel managers will adjust their T&E policies to account for AI as more tasks and processes become automated. Will managers need to approve every expense report? Will they need to review them at all? How can policies and rules be modified so that travelers spend as little time in T&E tools as possible? These are some of the questions they will start to ask in 2025."

Company Branding and User Flow

While it's not necessarily unique to the expense management industry, nearly all software users enjoy a fast, easy, and stylish UI/UX. Some things to keep in mind for a great user experience are having a comprehensive and simple user flow, and ensuring all features are consistently branded, especially with software integrations.

Integrations with Financial & Travel Software

Seamless integration with financial systems like accounting and payroll software is becoming a standard requirement for expense management solutions. This integration not only reduces manual data entry but also provides real-time insights into financial health. As a result, 82% of organizations now consider integration capabilities a top priority when choosing an expense management tool.11

Additionally, integrating travel software into applications can be important to many companies that prioritize business travel for their employees. Some common travel software to integrate for seamless and end-to-end employee spend management are rideshare operators, flight companies, hotels, and more.

Corporate Credit and Travel Card

Prepaid card solutions are offered by many spend management companies. They are often well-received by management and employees alike, due to immediate reimbursement for travel and business, more insights on user spending, and adjustable budget limits.

Discover What Custom Expense Management Technology Softjourn Can Create For You

As we navigate the ever-shifting terrain of expense management, staying ahead of the curve is crucial. Looking ahead to 2025, one thing is clear: technology continues to shape how we handle expenses.

There's no better time to take charge of your technology arsenal and add the features that will make your expense management solution stand out. Whether you represent a corporate powerhouse or a budding startup, being competitive in the expense management industry lies in embracing tech advancements.

Softjourn has a proven track record of partnering with major expense management players - specializing in app development, cloud migrations, integrations, automation, AI, and much more.

We're ready to develop tech solutions that will take your expense management software to the next level. Contact us today to get started on reaching new heights in 2025.