Would you still want to rely on a financial system that takes minutes to load, breaks under pressure, or can’t adapt to new compliance rules? Your clients don’t. And neither do your competitors.

Legacy systems were built to last, not to change. But in today’s market, standing still is risky.

Financial platforms need to move faster, integrate with new tools, and respond to constant shifts in regulation and user expectations.

That’s why more financial institutions are modernizing – not for the sake of shiny tech, but to stay competitive, secure, and in control.

This article explores what modernization really looks like in finance, the pressures driving it, and how financial firms are approaching it without disrupting critical services.

What Modernization Really Means in Finance

In financial services, modernization isn't just about better performance or cleaner interfaces. It's about rebuilding the foundation that enables secure transactions, rapid innovation, and ongoing compliance.

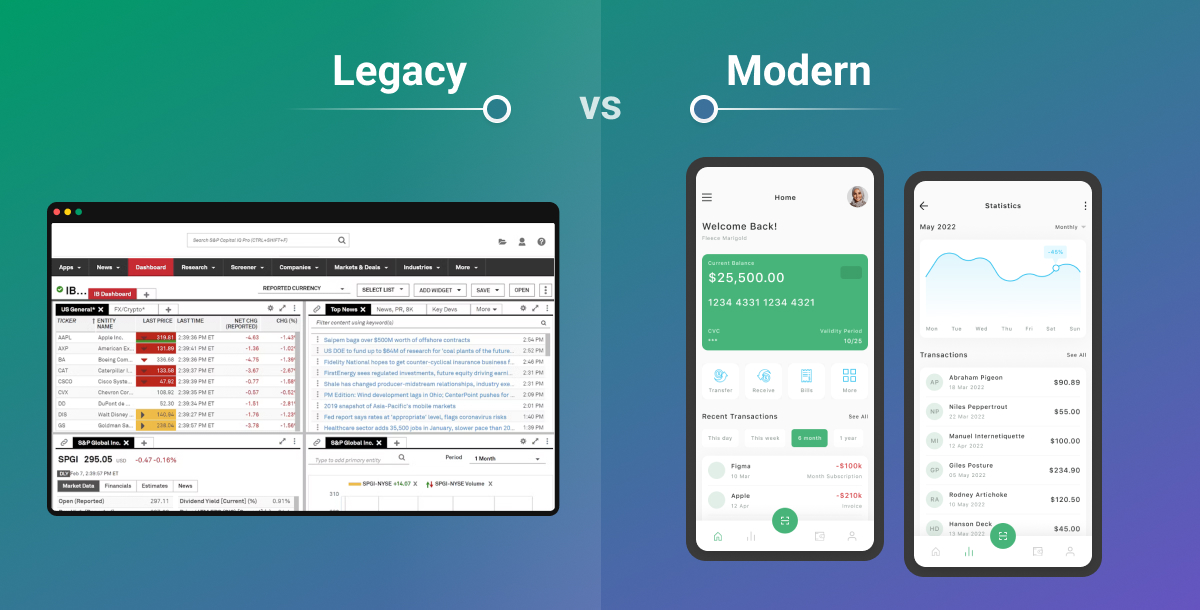

Many legacy systems were designed to be stable and long-lasting, but not necessarily flexible. Today, that inflexibility can slow product development, limit integrations, and increase the cost of maintaining compliance.

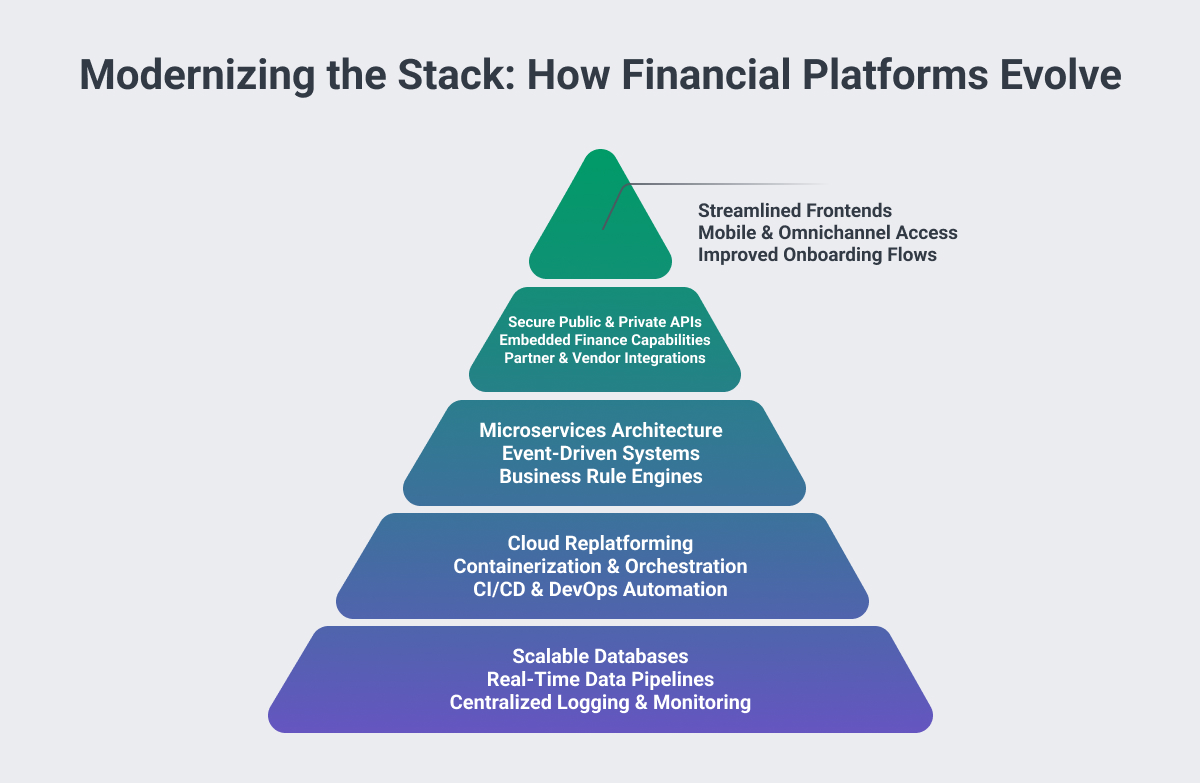

Modernization means rethinking the structure of critical systems. That might involve:

- Migrating from monoliths to modular services

- Decoupling the frontend from backend logic to speed up feature delivery

- Creating secure APIs for partners, card networks, or embedded finance tools

Unlike other industries, financial firms must modernize while navigating strict regulations and data handling requirements. Many take a hybrid approach to the cloud, using cloud-native infrastructure for customer-facing services while keeping sensitive workloads on private environments.

Incremental changes are common. Some firms start by replatforming a payments engine, replacing manual reporting tools, or automating onboarding and KYC processes. Others invest in real-time data pipelines to improve fraud detection or credit risk modeling.

In the end, modernization is about creating flexibility. It's what enables a financial company to launch new features faster, respond to regulatory changes efficiently, and stay competitive in a constantly evolving market.

Why Financial Firms Are Modernizing Now

The pressure to modernize in financial services has been building for years, but several recent trends have made it a top priority:

1. Rising Customer Expectations

Modern users expect seamless digital experiences. They want to open accounts in minutes, make instant payments, and access tools like budgeting or rewards without delays. Legacy systems, built for back-office efficiency rather than user-centric design, often can’t deliver that level of service without major workarounds.

2. Regulatory Complexity

With new rules around data privacy, open banking, and real-time payments, maintaining compliance on legacy platforms has become more difficult. Manual processes, hardcoded logic, and poor visibility across systems make it harder to adapt quickly and prove compliance under audit.

3. Security and Resilience Requirements

Modern cybersecurity threats and evolving fraud tactics require systems that can respond in real time. Legacy applications often weren’t designed for rapid updates, automated monitoring, or granular access controls. This leaves institutions more vulnerable and less agile when responding to incidents.

4. Competitive Threats from Fintechs and Big Tech

Fintech startups and embedded finance providers are offering faster, more personalized services built on modern infrastructure. Banks and traditional financial firms risk losing market share if they can’t match the pace of innovation. Some institutions are also being pushed to open up parts of their platforms via APIs to keep pace with open finance initiatives.

5. Cost and Talent Pressures

Maintaining legacy systems is expensive and often requires hard-to-find expertise. As fewer developers are familiar with outdated languages or platforms, the cost of keeping older systems running continues to rise. At the same time, modern engineering teams expect to work with cloud-native stacks and automation, not patch COBOL scripts.

These drivers have converged to create a sense of urgency. Financial institutions that delay modernization risk falling behind, not just technologically, but also in customer retention, compliance, and product development.

Common Modernization Approaches in Finance

Financial institutions typically can’t afford the risk or downtime of replacing core systems all at once. Instead, they rely on a mix of modernization strategies designed to minimize disruption while delivering incremental value.

Some of the most common approaches include:

1. Core Wrapping and API Enablement

Rather than replacing entire core banking or processing systems, many firms wrap legacy platforms with API layers. This approach allows new services and channels (like mobile apps or partner platforms) to connect to old systems without changing the underlying code. It’s often a first step toward modularity and enables faster rollouts of customer-facing features.

2. Cloud Replatforming

Rehosting parts of the infrastructure on cloud platforms like AWS, Azure, or GCP gives financial firms better scalability, cost control, and access to advanced services. In many cases, non-core workloads such as analytics, customer portals, or dev/test environments are migrated first. Some institutions also use hybrid cloud models to retain sensitive data in private infrastructure while gaining cloud flexibility elsewhere.

3. Microservices and Event-Driven Architectures

Breaking monolithic applications into microservices makes it easier to deploy changes, scale individual components, and experiment with new functionality. Many financial firms also adopt event-driven designs (using tools like Kafka or Amazon Kinesis) to support real-time notifications, fraud detection, and inter-service communication with less complexity.

4. Data Layer Modernization

Modern finance platforms require access to real-time data for fraud prevention, personalized offers, compliance tracking, and more. Upgrading to scalable databases, enabling data streaming, and cleaning up legacy ETL processes helps organizations make better decisions faster while reducing duplication and latency.

5. Frontend and UX Redesigns

While backend upgrades often take center stage, improving the frontend can deliver immediate impact. Whether through mobile app updates, improved onboarding flows, or accessibility enhancements, redesigning the interface improves usability and reduces friction for both customers and internal teams.

6. Legacy Feature Rebuilds

In some cases, outdated modules – such as reporting dashboards, statement generation, or money movement tools – are rewritten using modern frameworks to improve performance and maintainability. These targeted rewrites preserve key functionality while making it easier to expand in the future.

Common Challenges That Slow Modernization in Financial Services

Modernizing financial systems isn't as simple as flipping a switch. Financial institutions operate under strict regulations, serve millions of users, and often rely on decades-old infrastructure.

Below are some of the most common barriers that teams encounter:

1. Legacy Core Systems

Many banks and fintechs still rely on core systems built in COBOL or other outdated languages. These systems are deeply integrated across departments, making replacement or modification a slow and risky process. Even small changes can have wide-reaching impacts.

2. Regulatory and Compliance Constraints

Compliance isn't just a legal box to check, it directly affects how systems are built and changed. Any modification to data flows, storage, or authentication mechanisms must undergo rigorous internal and external reviews. This slows down the pace of development and requires heavy documentation.

3. Risk Aversion

In finance, downtime or bugs can lead to lost money, reputational damage, or legal exposure. Teams are understandably cautious, which makes experimentation difficult. This results in a culture where modernization is often postponed in favor of patching the existing system.

4. Lack of Unified Data Models

Over time, many financial institutions have created fragmented systems with inconsistent data formats. A single customer might appear differently in CRM, billing, and analytics systems. This makes it hard to modernize around APIs or enable advanced analytics without first consolidating or standardizing the data layer.

5. Overlapping Tech Stacks

Mergers, acquisitions, and siloed development efforts often leave financial organizations with overlapping tools that serve similar purposes. Rationalizing which systems to modernize, deprecate, or integrate can be a major hurdle, especially when teams are protective of their platforms.

Benefits of Modernization in Finance

While modernization comes with complexity, the payoff for financial institutions can be significant. It’s not just about faster systems but about enabling new capabilities, reducing risk, and supporting long-term business goals. Here are some of the most impactful benefits we’ve seen in financial and fintech platforms:

1. Faster Feature Delivery

Modern architectures like microservices and cloud-native platforms allow for smaller, independent deployments. This means teams can roll out updates, test features, and respond to market changes without waiting on long release cycles.

2. Improved Security Posture

Legacy systems often lack up-to-date security controls. Modernization introduces built-in encryption, secure authentication protocols, and better access control through modern frameworks and infrastructure. These help financial institutions meet compliance and reduce vulnerability to attacks.

3. Stronger Data Capabilities

Modern platforms can better support real-time analytics, behavioral tracking, and event-based decisioning. This opens the door to personalized user experiences, more accurate credit risk assessments, and early fraud detection powered by machine learning.

4. Lower Operational Costs

Moving to cloud or containerized infrastructure allows financial institutions to scale only what they need. This reduces overprovisioning, simplifies maintenance, and lowers long-term infrastructure costs, particularly when paired with good observability and auto-scaling.

5. Increased Partner and API Flexibility

A modern, modular system makes it easier to connect with payment providers, KYC vendors, and embedded finance tools. This not only speeds up partnerships but also allows institutions to offer richer, more customized services to clients without having to build every feature in-house.

Modernization in Action: Real Examples from Financial Services

At Softjourn, we’ve worked with a range of financial services companies – expense management platforms, prepaid card providers, embedded finance startups – each with unique modernization goals. Some needed to reduce infrastructure costs, others wanted to accelerate product updates, and many were simply ready to move beyond outdated, hard-to-maintain systems.

What they all gained was the ability to move faster, serve clients better, and adapt to change with confidence. These case studies show how modernization has helped our clients unlock new growth and build platforms ready for what’s next:

Seamless Cloud Migration for Open Banking Compliance

To meet new regulations and modernize their infrastructure, UPC partnered with Softjourn to migrate their Open Banking platform to AWS. The phased migration used serverless architecture to ensure PCI DSS compliance, scalability, and improved system performance. As a result, UPC reduced operational costs while gaining a future-ready foundation for innovation and growth.

Cutting $25K Annually with DevOps Consulting

A client in the expense management space needed help controlling AWS costs while maintaining performance and uptime. Softjourn’s DevOps team implemented serverless solutions, autoscaling strategies, and layered monitoring across environments. The result was more efficient operations, enhanced reliability, and annual AWS savings of over $25,000.

Smooth, Secure Database Migration for a Fintech Platform

Versapay needed to migrate their growing database to a more scalable system without downtime. Softjourn used AWS Aurora and Database Migration Service to sync data in real time, transform schema on the fly, and deliver cost-effective performance improvements. The new architecture now supports faster queries and smoother growth.

Modern Infrastructure for Regulated Cloud Accounting

When Bullet decided to become a Central Bank-regulated provider, they needed enterprise-grade infrastructure. Softjourn designed and executed a migration to AWS, enabling observability, seamless deployments, and disaster recovery. Bullet now operates on a secure, scalable system that supports compliance while opening the door for broader expansion.

Designing a Unified UI/UX for Financial Applications

Magic Software needed high-quality UI/UX for its finance and legal reporting platform across web and mobile. Softjourn’s design team delivered intuitive interfaces, toolkits, and a clickable demo with minimal onboarding. The client praised the outcome as both visually polished and easy to navigate, especially appreciating Softjourn’s proactive suggestions and communication style.

Building Trust Through Discovery and Strategic Rewrites

Vanco Payments engaged Softjourn for a major rewrite of its Java-based system to .NET and to map integrations for new payment processors. Through a structured discovery phase and strategic technical planning, Softjourn delivered architecture documentation, de-risked future development, and enabled smoother onboarding. The collaboration restored the client's trust in third-party partnerships and accelerated their modernization journey.

Supporting System Transition with Product Definition and QA

To support the rollout of their 2.0 fintech platform, Tribal Credit turned to Softjourn for documentation, QA, and team extension. We helped define their existing system, created a technical architecture for 2.0, and maintained 1.0 while transition efforts were underway. Our clear documentation accelerated onboarding and reduced risk. The client cited our proactive guidance and rapid issue resolution as essential in meeting their go-to-market timeline.

Scaling Securely with Hybrid Cloud and DevOps Enhancements

Softjourn partnered with PEX to modernize their infrastructure during product expansion, migrating from Windows to Linux, introducing Docker containers, and adopting Zero Trust Network Access. We also upgraded Azure security, deployed an advanced SIEM system, and tightened vulnerability management. These changes enhanced PCI compliance, improved scalability, and positioned the client for cost-effective, secure growth in a regulated environment.

Progressive Migration from AngularJS to React for Expense Platform

Softjourn guided a leading expense management provider through a progressive migration from AngularJS to React, maintaining uptime and functionality throughout. We crafted a detailed strategy, tackled performance-slowing bugs, and ensured uninterrupted card issuing and transaction management. Post-migration, the platform saw faster load times and a cleaner codebase.

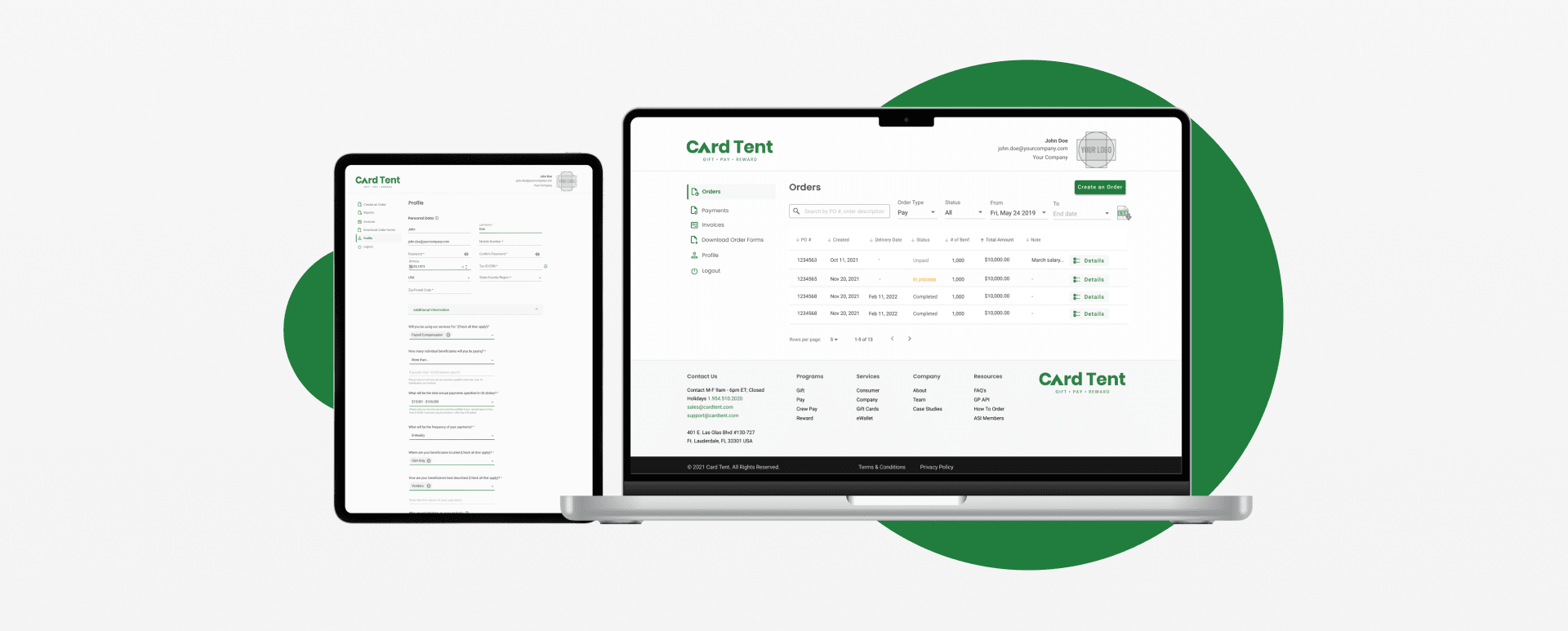

Accelerating Fintech Launch with Strategic API Integration

Card Tent partnered with Softjourn to build and scale their global corporate payments platform, integrating third-party APIs while maintaining product flexibility. Softjourn helped navigate API limitations and designed a smooth integration roadmap, drawing on past experience with the client. The result: a scalable payout solution with improved UX, enhanced reliability, and a clear path for future growth.

Don’t Build for Tomorrow on Yesterday’s Systems

Modernization isn’t a nice-to-have anymore. It’s the only way to stay compliant, scalable, and ready for what’s next.

Whether it’s rethinking your infrastructure, enabling smarter integrations, or just finally replacing that legacy dashboard, every step forward makes a difference.

If you're ready to modernize without the growing pains, let's talk. Softjourn can help you define the roadmap, build the right solution, and move at your pace.