Cloud computing has evolved from an emerging technology to the backbone of modern business infrastructure. In 2025, the global cloud market reached $913 billion – nearly six times its 2020 value – and shows no signs of slowing down.

But market size tells only part of the story. Today, over 94% of enterprises use cloud services, with half of all workloads now running in public cloud environments. Organizations are spending 45% of their IT budgets on cloud infrastructure, and by 2026, nearly all new digital workloads will be built on cloud-native platforms.

This shift brings both opportunity and complexity. While 94% of businesses report improved security after cloud adoption, 98% have also experienced cloud breaches in the past two years. Cost management has emerged as the #1 challenge, with organizations wasting an estimated 31% of their cloud spending on unused resources.

This comprehensive report compiles over 100 statistics across market growth, adoption trends, regional differences, security concerns, and future projections.

Whether you're planning a cloud migration, evaluating multi-cloud strategies, or assessing security investments, these data points provide the foundation for informed decision-making in 2026 and beyond.

Market Size and Growth

Cloud computing has grown into a massive global market and continues to expand rapidly. Key figures and projections include:

- Soaring market value: The global cloud computing market reached roughly $913 billion in 2025, a huge jump from about $156 billion in 2020. Analysts predict it will surpass $1 trillion by 2028, underscoring robust growth.

- Rising IT spend share: Cloud is consuming an ever-larger share of IT budgets. In 2021, under 17% of enterprise IT spending went to public cloud, but by 2026 it’s expected to account for over 45% of IT spending. Gartner also estimates that 51% of key IT spending will shift to cloud by 2025, up from 41% in 2022. Traditional on-premise investments are shrinking accordingly.

- Cloud analytics as a sub‑segment: the global cloud analytics market is projected to grow from $35.7 billion (2024) to $118.5 billion (2029).

Cloud Adoption and Usage

In 2026, adoption of cloud computing will be nearly ubiquitous across organizations of all sizes. Notable statistics illustrate the breadth of cloud usage:

- Near-universal adoption: Over 94–96% of companies are now using cloud services in some form. Among large enterprises (1000+ employees), more than 94% have significant portions of their workloads in the cloud. Only about 3% of enterprises have no plans to move to the cloud.

- Workloads moving to cloud: On average, companies run about 50% of their workloads in public clouds now. This is a steady climb – e.g. in 2022 only ~39% of organizations ran over half their workloads in cloud. Small and mid-size businesses are following suit: roughly 63% of SMB workloads (and 62% of SMB data) are now cloud-hosted. Few firms plan to reverse course – only ~5% report plans to migrate any workloads back on-premises.

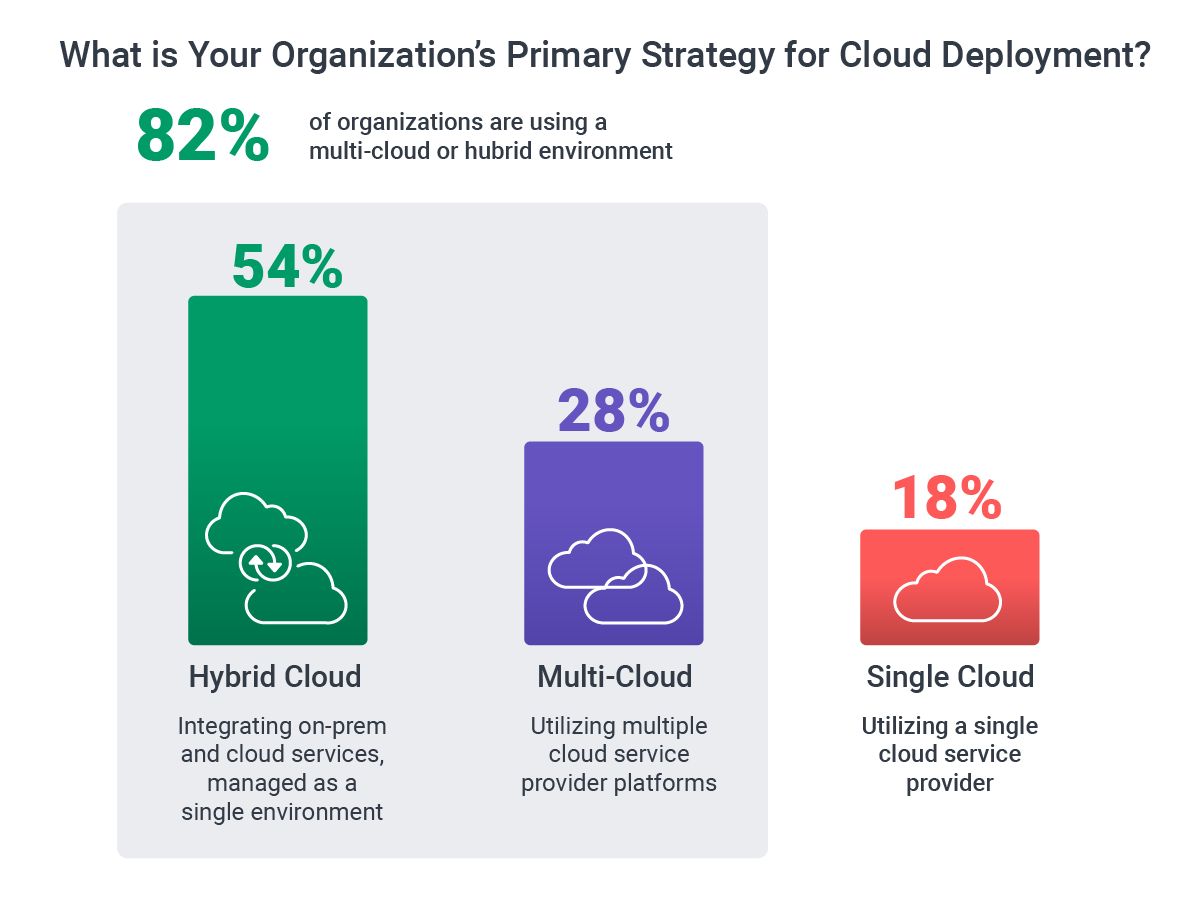

- Multi-cloud and hybrid are the norm: Hybrid and Multi-Cloud Strategies on the Rise: Over 78% of respondents utilize two or more cloud providers, underscoring the growing importance of multi-cloud approaches to enhance resilience and leverage specialized capabilities. 54% of organizations have adopted hybrid cloud models, integrating on-prem and public cloud environments to optimize flexibility and control. Only a small minority (~9%) use a single public cloud provider exclusively.

- Hybrid is a favorite:82% of IT decision-makers using a hybrid cloud are more satisfied than those using any other cloud type.

- Cloud services per organization: Organizations today leverage a vast ecosystem of cloud-based tools. The average enterprise uses about 1,300 different cloud services (applications and platforms) across departments. Individual employees also interact with many cloud apps – one survey found workers use 36 cloud-based services daily on average. This highlights how deeply cloud computing is embedded in day-to-day operations.

- The Cloud is bringing results:82% of respondents who have fully integrated cloud into their business strategies report superior performance compared to those who have not.

- Data is moving to the cloud: Over 60% of all corporate data is now stored in the cloud rather than on local servers. Personal usage has grown as well – the number of people using consumer cloud storage (Dropbox, Google Drive, iCloud, etc.) has more than doubled from 1.1 billion in 2014 to about 2.3 billion users today.

Cloud vs. On-Premises Trends

Cloud computing is rapidly overtaking traditional on-premise infrastructure in IT environments:

- Enterprise workload shift: Companies are steadily migrating away from in-house data centers. Now, only about 30-40% of enterprise applications still ran on traditional on-prem servers, down from roughly 50% in 2019. This on-prem footprint will likely be even smaller by 2026 as cloud adoption accelerates. Nearly half of enterprises now pursue a “cloud-first” approach for new systems.

- IT budget allocation: Organizations are dedicating the majority of IT spend to cloud services. Gartner projects that over half of enterprise IT spending will go to public cloud by 2025 (versus ~41% in 2022). In fact, many companies had aimed to direct ~80% of their IT hosting budgets to cloud by 2024. This reflects a strategic pivot to renting computing resources (IaaS, PaaS, SaaS) instead of expanding on-premise hardware.

- New workloads default to cloud: Looking forward, very few new applications will be deployed in on-site servers. Gartner research predicts 95% of new digital workloads will be developed on cloud-native platforms by 2026, up from just 30% in 2021. In other words, nearly all new IT projects are now targeting cloud environments as the default.

Cloud Adoption by Region

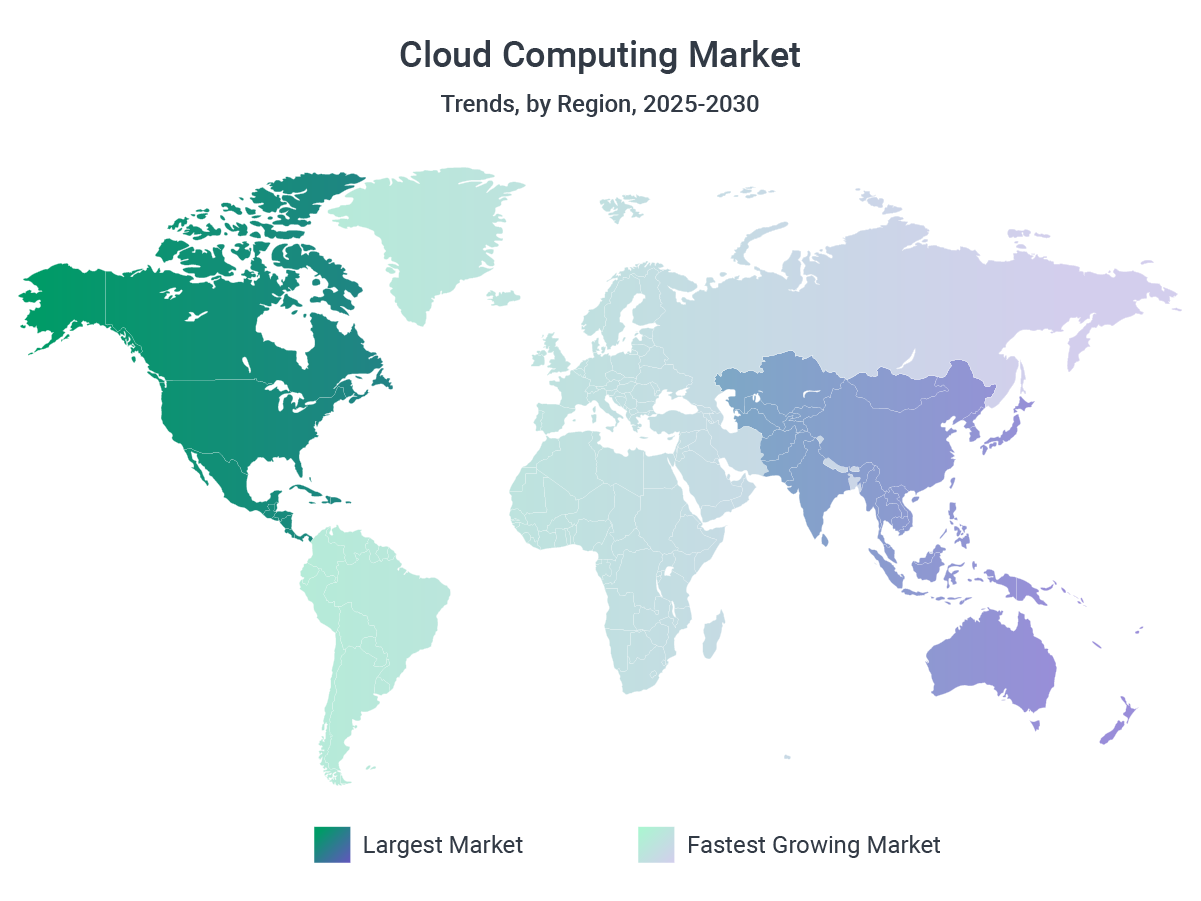

Cloud computing is a global phenomenon, but adoption is heaviest in certain regions:

- North America: A 2025 analysis shows North America remains the largest cloud market, representing over 38% of total global spending.

- Europe's cloud spending is significant but smaller. For 2024, the European cloud market accounted for about 21% of global spending, or $70 billion. Europe’s cloud market in 2025 is at an estimated $201.86B, projected to grow to ~USD 428B by 2030.

- Emerging markets growth: Cloud adoption is rapidly rising outside the traditional tech hubs. In developing regions, around 40% of organizations are now evaluating or planning cloud strategies as of 2024. For instance, surveys in parts of Sub-Saharan Africa find roughly 30% of companies are already using some cloud services, and many more are in planning stages. Other regions like Eastern Europe, Latin America, and the Middle East are also increasingly investing in cloud infrastructure, albeit from a smaller base. Regional regulations and data sovereignty concerns continue to influence cloud uptake patterns worldwide.

- Asia-Pacific and others: The Asia-Pacific region (led by China, India, etc.) is a major growth area for cloud, though global share is still concentrated among U.S.-based providers. China’s Alibaba Cloud, for example, has become the fourth-largest cloud provider globally and dominates cloud services in China/Asia with roughly 4% of global market share.

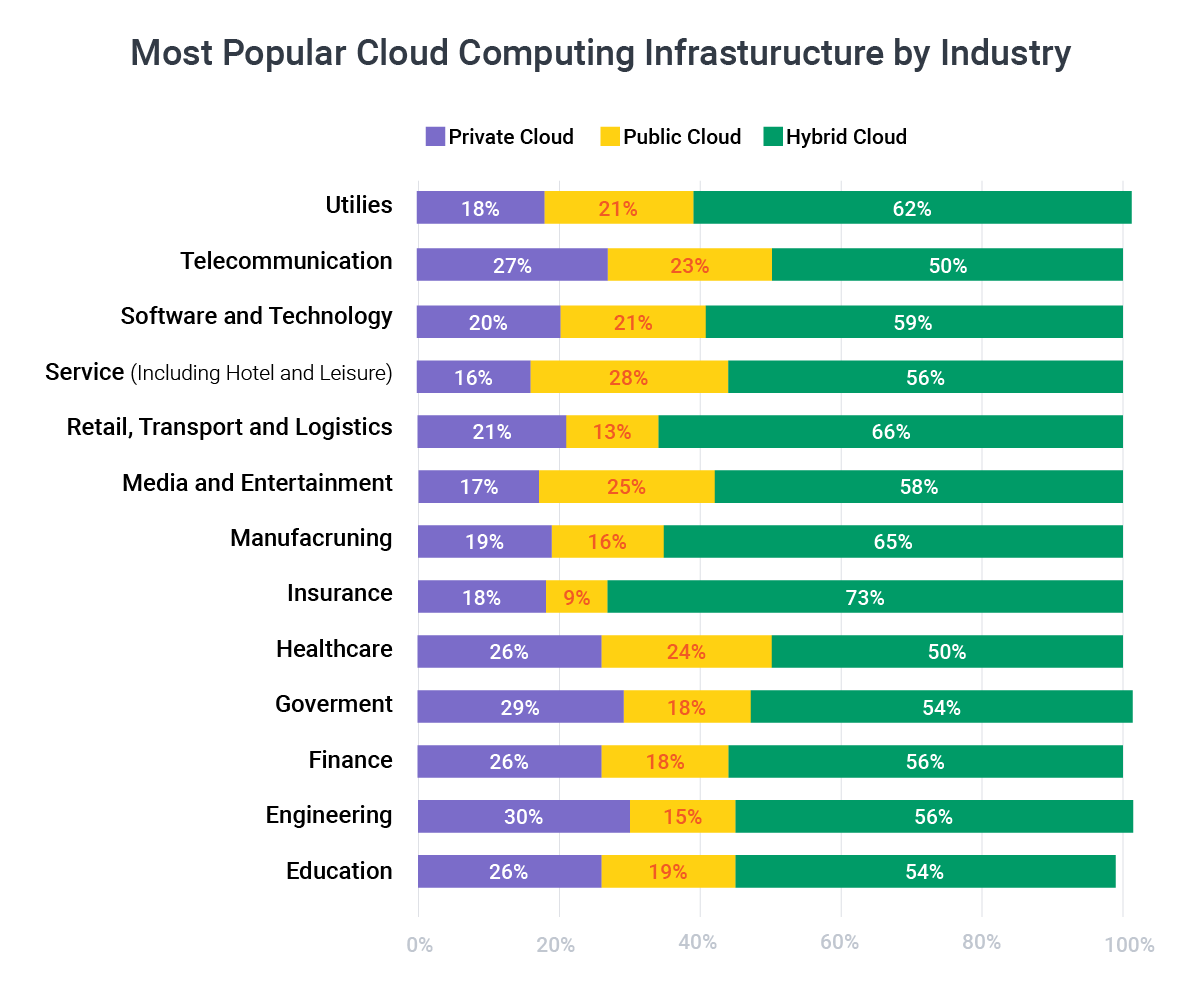

Cloud Adoption by Industry

Cloud penetration varies across industries, with some sectors embracing it faster than others:

- Leaders vs. laggards: According to industry surveys, Retail & E-commerce, Banking/Finance, and Technology (software) companies have been the most aggressive in adopting cloud services. In contrast, the government sector has been among the slowest – only about 34% of government organizations were using cloud services as of 2025, and traditional manufacturing firms were also low at ~60% adoption. This gap suggests that highly regulated and public sectors trail behind more tech-centric industries in cloud migration.

- Financial services: Despite heavy regulations, the financial industry has largely moved to the cloud. An estimated 98% of financial services organizations now use cloud computing in some form. Many banks and insurers leverage the cloud for data processing, customer services, and even core systems. In fact, 81% of insurance companies use cloud-based technology for claims management (with 25% of insurers using only cloud for this). Additionally, cloud-based platforms held about 75% of the expense management software market in 2024.

- Telecom and IT: The telecommunications industry shows a distinctive pattern – it heavily uses private clouds. Over 64% of telecom companies utilize private cloud infrastructure, making it the only sector where private cloud usage outstrips public cloud. Overall, most tech, telecom, and IT service companies have high cloud adoption, often using a mix of multiple public clouds and their own private or edge clouds for maximum flexibility.

- Use of cloud in heavily regulated industries: Healthcare providers are increasingly adopting cloud (e.g., for electronic health records and analytics), though concerns about data privacy mean a hybrid approach is common. 42% of finance and healthcare organizations rely on private cloud to address compliance requirements. One study noted that health records now make up about 23% of sensitive data stored in the cloud, as hospitals and clinics cautiously move data to secure cloud environments.

- Other Industries: Education, real estate, and industrial sectors are also investing in cloud-based software – for example, a whopping 80 percent of ed tech leaders say their districts are using cloud-based software.

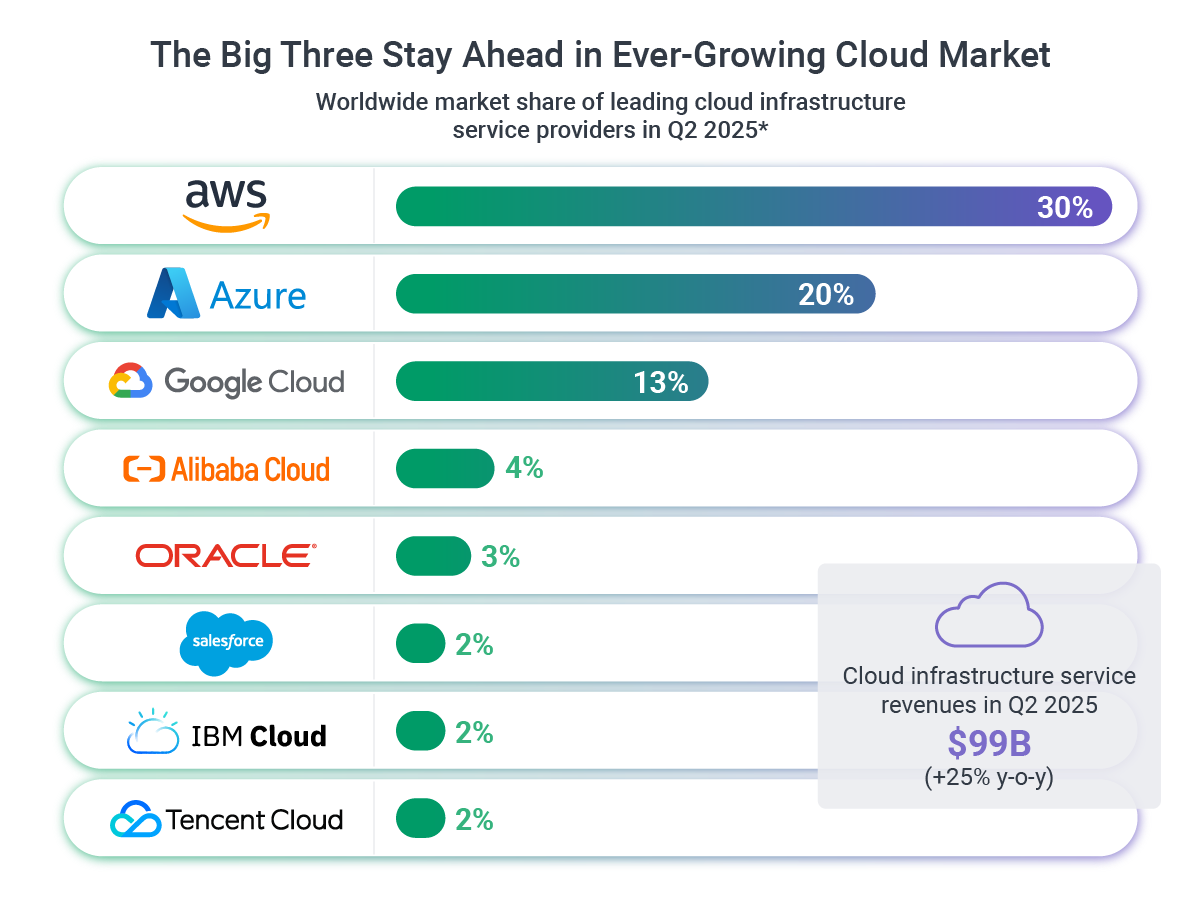

Major Cloud Providers Market Share

The cloud infrastructure market is concentrated among a few dominant providers (the “hyperscalers”):

- AWS, Azure, and Google dominate: Amazon Web Services (AWS) remains the largest cloud service provider, holding roughly 30% of the worldwide cloud infrastructure market in 2025. Microsoft Azure is the second-largest with about 20% share, and Google Cloud is third at around 13% share. Together, these top three control about 68–71% of the public cloud market by revenue.

- Other providers: After the “Big Three,” the remaining market is split among several companies each with single-digit percentages. Alibaba Cloud (the leading Chinese provider) holds roughly 4% globally, followed by Oracle Cloud (~2–3%), IBM Cloud (~2%), and others like Salesforce, Heroku, and Tencent Cloud. These smaller players often focus on particular regions or niches (e.g. Alibaba in Asia, Oracle in enterprise apps). The trend in recent years shows the top providers steadily increasing their share, as many organizations gravitate to the large ecosystems offered by AWS, Azure, and Google.

- Cloud service segments: In terms of service models, Software-as-a-Service (SaaS) is the largest segment of cloud computing by spending, followed by Platform-as-a-Service (PaaS) and Infrastructure-as-a-Service (IaaS). (For instance, SaaS revenue is projected around $390 billion in 2025, versus $209 billion for PaaS and $180 billion for IaaS.) AWS is the clear leader in IaaS offerings, while Microsoft Azure often leads in PaaS capabilities for enterprises. Niche services like cloud databases, AI/ML platforms, and content delivery networks have their own set of leading providers (e.g. Snowflake and Databricks in data cloud, Cloudflare and Akamai in CDN).

Data Storage and Cloud Traffic

The migration of data to the cloud and the explosion of global data generation are key drivers of cloud growth:

- Half of the world’s data is in the cloud: By 2025, the world is expected to generate 200 zettabytes (200 trillion gigabytes) of data annually. Roughly 50% of all data globally will be stored in cloud environments by 2025, up from just 25% stored in cloud in 2015. This illustrates a massive shift of data away from on-premises storage to cloud-based storage and data lakes.

- Business data in the cloud: Within enterprises, a majority of data is now cloud-resident. Around 62% of business data is already stored in the cloud as of 2025. This migration raises the importance of cloud data management and security.

- Big data and IoT impact: The continued growth of Internet of Things (IoT) devices and digital services means exponentially more data flowing through clouds. By 2025 there will be an estimated 75+ billion IoT devices in use worldwide generating data – much of which feeds into cloud platforms for storage and analytics. Cloud providers are increasingly building distributed edge networks to handle data processing closer to where it’s generated, highlighting how cloud infrastructure underpins the data-driven economy.

- Cloud traffic and content delivery: The dominance of cloud is evident in internet traffic patterns as well. A large portion of web content, streaming media, and application traffic is served via cloud data centers and CDNs. As one example, Netflix’s video streaming platform runs entirely on AWS cloud after completing a multi-year migration. Many other major digital services (from social networks to enterprise software) now rely on cloud-hosted backends, contributing to the majority of internet traffic originating from cloud data centers.

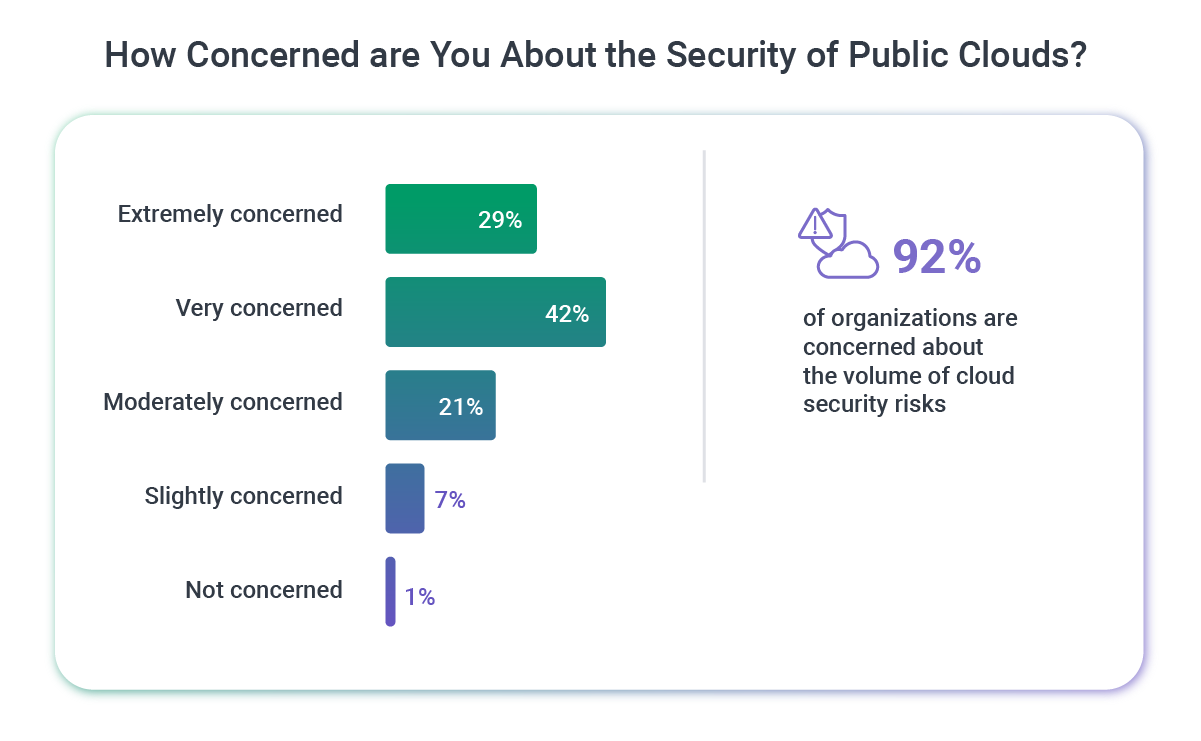

Cloud Security and Compliance

Security remains a pivotal concern in cloud computing, even as many organizations report improved security post-adoption. Here are some key cloud security statistics:

- Widespread security concern: An overwhelming 95% of companies express concern about cloud security risks. Protecting data and workloads in multi-tenant cloud environments is a top-of-mind issue for virtually every cloud adopter. The biggest perceived threats include misconfigurations, unauthorized access, and insecure interfaces/APIs. In fact, cloud misconfiguration issues are blamed for roughly 68% of potential security vulnerabilities – making it the #1 ranked cloud security threat by organizations.

- High incidence of cloud breaches: Along with the concern has come real incidents. 98% of companies experienced cloud breaches in the last two years, with 83% having multiple breaches.

- Data Breaches: 30% of breaches involving data distributed across multiple cloud, private cloud, and on-premises environments incurred the highest average costs, reaching $5.05 million per breach. These multi-environment breaches also took the longest to resolve, at 276 days on average, due to reduced visibility and control.

- Post-migration security outcomes: Despite the risks, many organizations actually see improved security after moving to the cloud. Remarkably, 94% of businesses report that their overall security posture improved following cloud adoption. This may be due to cloud providers’ advanced security tools and standardized updates. Additionally, 91% of organizations say using cloud services has made it easier to meet government compliance requirements. Cloud platforms often have built-in compliance certifications and controls that help with regulations (if configured properly). In essence, while cloud introduces new security challenges, it also offers powerful security capabilities that can increase protection if leveraged well.

- Common cloud attack vectors: The nature of cyberattacks has evolved with cloud usage. Phishing is involved in at least 25% of cloud-related attacks as attackers steal cloud login credentials. Insider threats and human error are also problematic: an estimated 82% of cloud misconfigurations (and the incidents stemming from them) are caused by human mistakes, not software flaws.

- Low Confidence in Real-Time Threat Detection: Survey data highlights that 64% of respondents lack confidence in their organization’s ability to handle real-time threat detection.

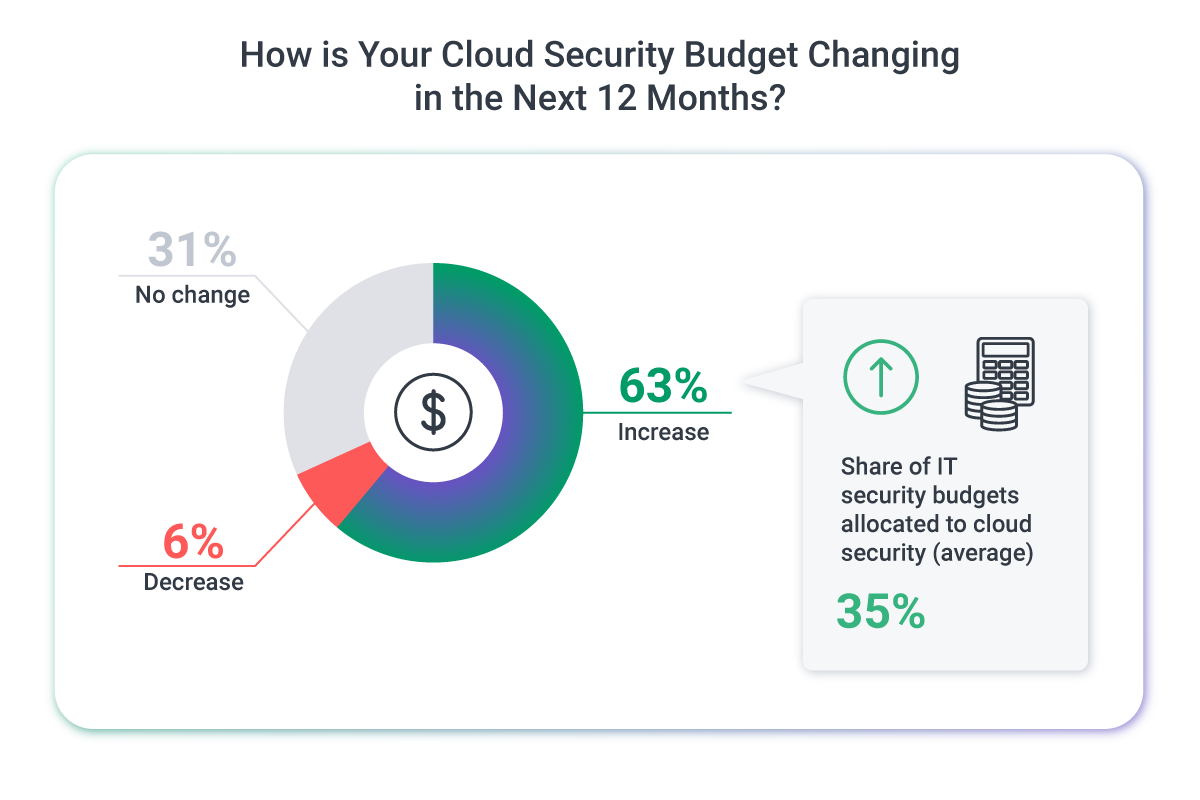

- Security investments rising: In response to these risks, companies are ramping up cloud security efforts. Over 51% of organizations plan to increase their cloud security budgets and tooling. Cloud providers continue to add security services (encryption, monitoring, threat detection) and many firms adopt a zero trust approach for cloud access. Analysts project the Zero Trust security market will reach $78.7 billion by 2029 as businesses invest in new architectures suited for cloud and hybrid IT.

- Attack surfaces are growing:36% of organizations have at least one cloud asset supporting more than 100 attack paths, while 13% have at least one cloud asset supporting more than 1000 attack paths.

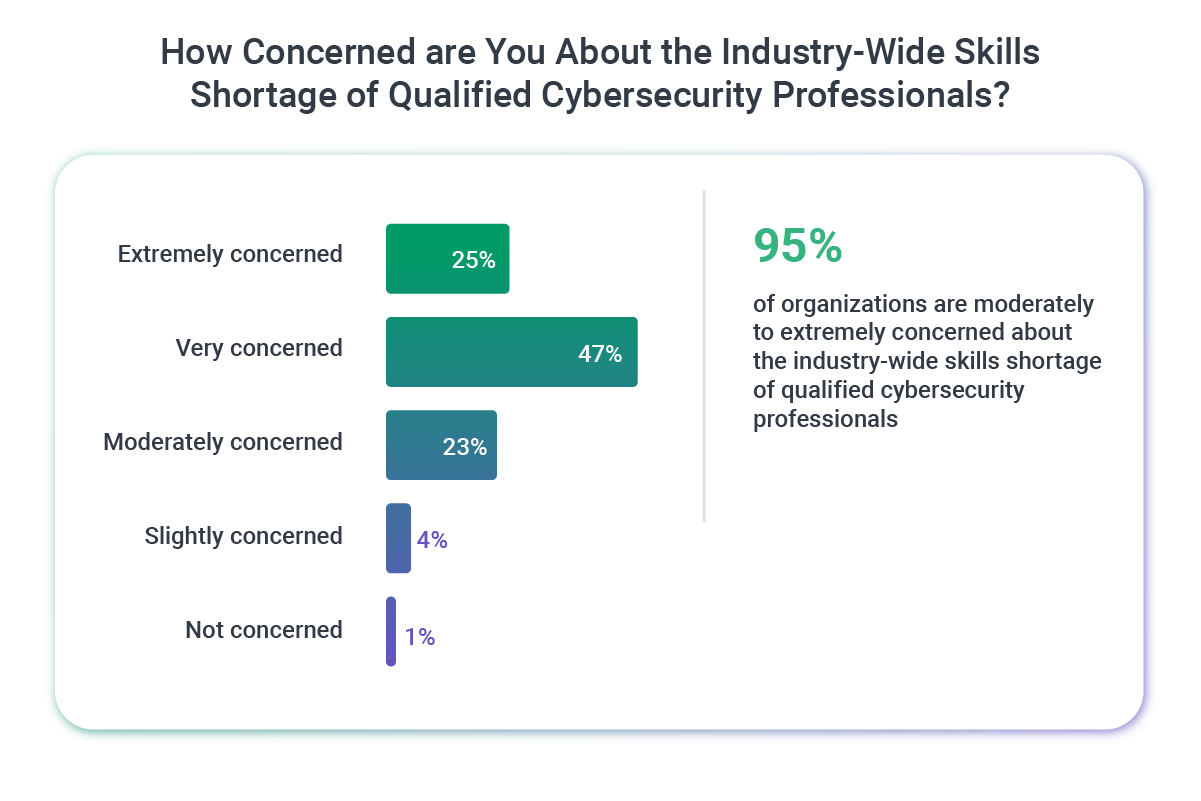

Cloud Cost Management and Challenges

As cloud usage grows, organizations face new challenges in governance, cost control, and skills. Some notable statistics on cloud challenges include:

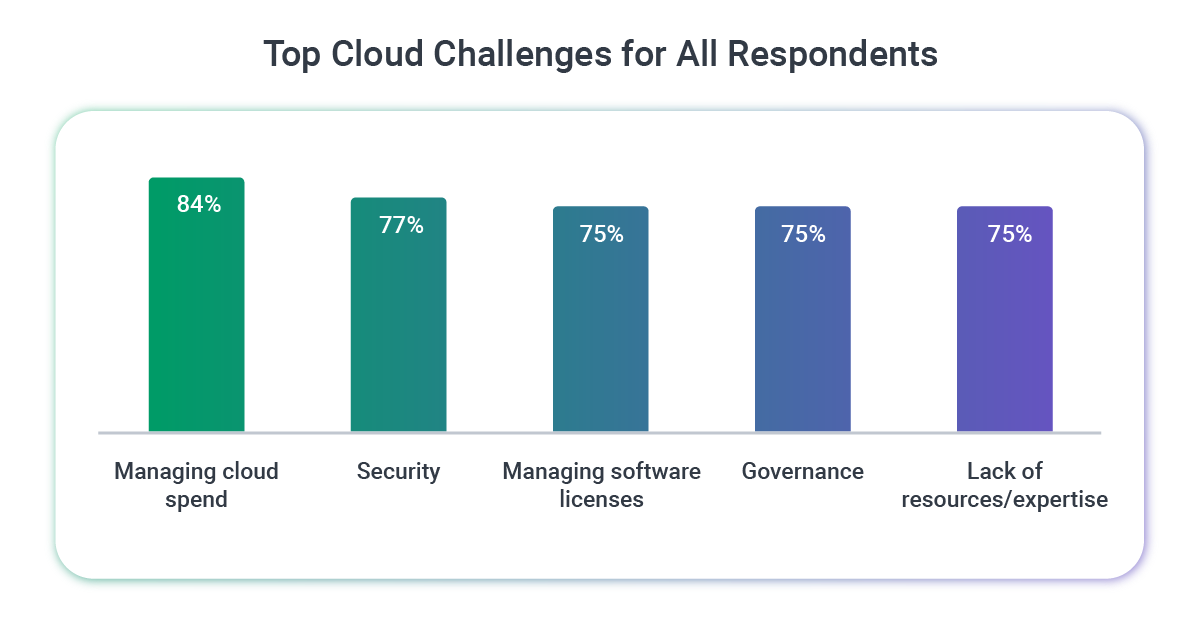

- Top challenges – cost now #1: Managing cloud spending has emerged as the number-one challenge for cloud decision-makers, cited by 84% of organizations. Cost management is followed by security, lack of resources/expertise, compliance, managing software licenses, and governance.

- Wasted cloud spend: A significant portion of cloud spending is not efficiently used. Studies estimate that around 31% of IT leaders waste half their cloud spend is wasted on excess or idle resources. For example, many companies over-provision capacity or forget to turn off unused instances, leading to bill waste.

- Skills gap: Talent shortfalls are another hurdle. About 76% of organizations report a shortage of skilled cloud professionals and experience difficulty hiring or training people for cloud architecture, security, and DevOps roles. This skills gap can hamper cloud adoption or lead to misconfigurations. In response, firms are investing in cloud certifications and managed services to fill the gap.

- Other concerns: Along with cost and skills, companies remain concerned about vendor lock-in and regulatory compliance in the cloud. Nearly 59% of tech leaders say they use multi-cloud or hybrid strategies specifically to avoid dependence on a single vendor’s ecosystem or security controls. Data sovereignty is another issue – Three in four leaders express concern about geopolitical risks associated with storing and managing data in global cloud environments.

Future Outlook and Projections

Looking ahead, cloud computing is set to become even more central to business technology. Some forward-looking insights:

- Cloud-first becomes standard: Industry analysts predict that by 2025, over 85% of organizations will have adopted a cloud-first strategy for their IT operations. This means new systems will be built in the cloud by default unless there’s a compelling reason to do otherwise. Cloud is no longer an experimental option but the default platform for new innovation.

- Hybrid and multi-cloud reign: Rather than consolidating on one provider, companies will continue diversifying. By 2027, Gartner expects 90% of organizations will use a mix of multiple clouds and on-premises (hybrid) in their infrastructure. The vast majority are already multi-cloud as noted, and this will persist as a strategy to optimize cost, performance, and resilience. The future IT landscape will be a federated one, where workloads move between clouds and edge locations fluidly.

- Market growth and innovation: The cloud market shows no signs of slowing. In 2025 the worldwide end-user spending on public cloud services reached $723.4 billion, up from $595.7 billion in 2024, with estimates to see the total cloud market possibly hitting $2+ trillion by 2030. Key drivers will be advaned technologies running on cloud – for example, AI and machine learning workloads have massively boosted cloud usage (Generative AI alone contributed to half of cloud revenue growth in 2024 and 2025). Similarly, edge computing and serverless services are rising quickly (the serverless market is projected to quadruple from 2020 to 2025), extending the reach of cloud to new applications.

- AI adoption has gone mainstream: Most organizations are leveraging AI in the cloud, introducing new risks, including AI-related CVEs that enable remote code execution. In 2025, 84% of organizations now use AI in the cloud and 62% of organizations have at least one vulnerable AI package in their cloud environment.

- Cloud strategies will rapidly: Over the next two years, 24% of organizations plan to accelerate public cloud adoption and 20% of respondents plan to increase private cloud investments. Hybrid cloud also remains a key component of cloud strategy, as 48% of respondents consider hybrid cloud crucial for their IT operations over the next 12-24 months.

- Cloud as critical infrastructure: By 2028, experts suggest cloud computing will be essentially a required baseline for competitiveness in business. Organizations that fully leverage cloud ecosystems are expected to innovate faster and adapt more readily.

- What’s Next for Cloud Providers: On the infrastructure side, cloud providers are heavily investing in data centers, networking, and specialized hardware (e.g. GPUs / AI accelerators) to serve workloads like AI training, inference, large-scale analytics.

The Cloud-First Future Is Here

The data paint a clear picture: cloud computing is no longer optional: it's foundational. The statistics in this report reveal several critical trends:

- Scale and momentum are unprecedented. The cloud market is approaching $1 trillion, with AI workloads contributing to half of recent revenue growth. Nearly all new workloads will be cloud-native by 2026.

- Security is improving but remains complex. While most organizations report better security posture post-migration, misconfigurations and human error remain the leading causes of vulnerabilities. Investment in zero trust architectures and cloud security tools continues to rise.

- Cost management is the new frontier. As cloud adoption matures, controlling spend has become more critical than initial migration. Organizations that master cost optimization, multi-cloud governance, and resource management will gain a competitive edge.

- Hybrid and multi-cloud are the standard. The days of single-provider strategies are over. Organizations are mixing public clouds, private infrastructure, and edge computing to optimize for performance, cost, compliance, and resilience.

As we move deeper into 2026, cloud computing will continue to underpin digital transformation, AI innovation, and global business operations. The organizations that treat cloud as strategic infrastructure will be best positioned to adapt, scale, and compete in an increasingly digital economy.

Ready to optimize your cloud strategy? We help organizations navigate cloud migrations, implement FinOps and DevOps best practices, and build expert teams to drive results. Get in touch to learn how we can support your cloud journey.