The expense management industry has come a long way. What was once viewed as a necessary but unremarkable part of back-office operations is now central to a company’s ability to control spend, ensure compliance, and drive efficiency. As the market matures, so do the expectations placed on the platforms that serve it.

This article isn’t for companies looking to choose an expense management provider. It’s for the people building and improving those platforms - the product owners, engineers, and executives behind the scenes.

You likely already offer a solid product with a strong set of features. But you may also be wondering what’s next: where should we invest, and what are we missing?

Let’s start with the fundamentals. These are the core capabilities that every competitive expense management platform should already have in place. After that, we’ll explore the more advanced tools and differentiators that will set your platform apart.

Core Capabilities Every Expense Management Platform Should Have

There’s a baseline today that’s no longer optional. Platforms are expected to offer a seamless, secure, and scalable experience - and not just for administrators - but for every employee and finance team that depends on the system.

A Reliable, Cross-Platform Experience

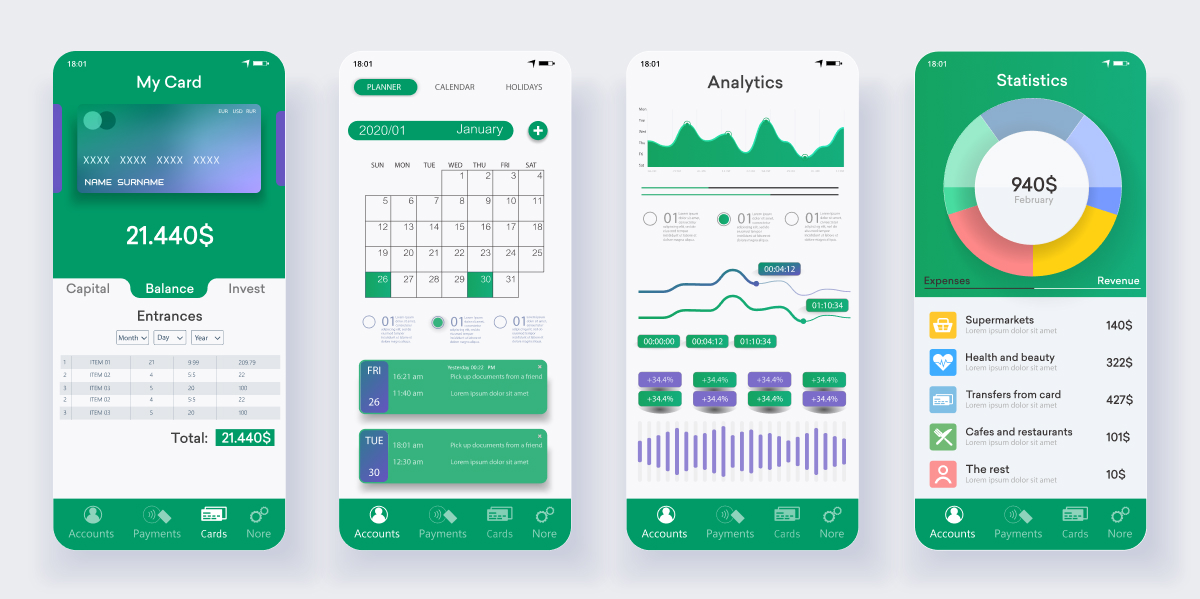

User experience matters more than ever. A strong expense platform should offer fully functional mobile apps for both iOS and Android, alongside a clean and intuitive web dashboard. These apps aren’t just for checking balances. Users expect to request funds, upload receipts, and manage transactions with minimal friction.

One of our clients, PEX, understood this early. We partnered with them to create mobile apps for both admins and cardholders. The result? A major reduction in support calls and a better experience for users who no longer needed to call just to check a balance or verify a transfer.

In a Nutshell: User Experience (Web & Mobile)

- Native web and mobile apps (iOS and Android)

- Frictionless UI/UX designed for non-technical users

- Customizable interface to match client workflows and branding

- Accessibility-ready (WCAG compliance or similar)

Infrastructure That Supports Growth

As usage grows, your platform should perform consistently without requiring a rewrite every time you scale. A modern architecture, such as cloud-native or hybrid, and using current frameworks like .NET 6 or Spring Boot, is essential for staying responsive and resilient as demand increases.

One Softjourn client - an established expense management platform - needed to migrate from AngularJS, which had reached end-of-life, to a more modern and scalable framework. Rather than risk downtime or disrupt day-to-day card operations, the platform chose a progressive migration to React.

This approach allowed the team to gradually refactor the application without interrupting service, ensuring continued performance for thousands of users while upgrading to a more flexible and high-performing tech stack.

As a result, the client saw faster page loads, fewer bugs, and a more future-ready architecture to support new features and ongoing growth.

In a Nutshell: Infrastructure & Tech Stack

- Built with a modern, well-documented tech stack

- Cloud-based or hybrid deployment options

- Designed with APIs-first for integrations and future extensibility

- Regular system updates and long-term tech roadmap visibility

Security and Compliance Built-In

Security can’t be an afterthought. At a minimum, platforms need robust encryption, PCI DSS compliance, and multi-factor authentication. But today’s leaders are going further, introducing Zero Trust Network Access, fine-grained user permissions, and proactive threat monitoring.

In our work with the expense management platform, PEX, we addressed vulnerabilities like IDOR and helped implement a more advanced SIEM system across their cloud environments. These efforts not only improved security posture but also laid the groundwork for faster compliance audits and better incident response.

In a Nutshell: Security & Compliance

- End-to-end encryption of sensitive financial data

- Multi-factor authentication login options

- Role-based access controls and user permission levels

- Regular security audits and penetration testing

- Audit trails and compliance-ready (PCI DSS, GDPR, SOC 2, etc.)

- Biometric login (Face ID, fingerprint)

- Role-based access controls

Blockchain-Based Audit Trails (Optional)

Some expense platforms are beginning to experiment with blockchain-based verification for sensitive financial records. While still emerging, this approach creates tamper-proof logs for audits and compliance reviews.

For companies managing large volumes of spend data or subject to frequent external audits, immutable transaction histories offer a powerful new safeguard against fraud and unauthorized changes.

Configuration Tools That Don’t Require a Developer

Administrative users need flexibility without relying on developers. That means customizable rules, editable report fields, and intuitive dashboards that give non-technical users control. If your clients still need to file support tickets just to change an expense type or modify approval rules, you’re introducing friction.

To improve admin flexibility and reduce support burden, one leading expense management platform partnered with Softjourn to expand its rule customization and reporting capabilities. We helped migrate features from a legacy UI into a more modern, editable interface, enabling users to define approval rules, modify field visibility, and create custom expense types without developer assistance.

The result was a more agile configuration experience that allowed finance teams to adjust policies and reports in real time, which helped cut down on manual processes and boosted user satisfaction across a diverse global customer base.

In a Nutshell: Customization & Maintenance

- Modular, configurable features (no heavy dev lifting for small changes)

- Easy for internal teams to update rules, UI, or workflows

- Admin dashboard for self-service management

- Great documentation and tutorials for both internal teams and end users

Support That Actually Helps Clients

Even the most well-designed platform needs a support system that empowers users, not frustrates them. A searchable knowledge base, well-structured onboarding flows, and contextual tooltips can prevent confusion before it starts.

The best platforms also offer white-labeled support content, so clients can help their own users without relying on your team for every question.

For platforms serving global organizations, multilingual support and customizable help centers are becoming essential. And while live chat and callbacks are valuable, proactive tools – like real-time alerts when a card is declined or a report is missing information – help users resolve issues before they escalate.

In a Nutshell: Client Support & Documentation

- Clear in-app onboarding flows and tooltips

- Comprehensive knowledge base and searchable FAQs

- White-labeled help content (so your clients can support their users too)

- Multilingual support (especially for international clients)

- Real-time expense tracking, custom alerts, and visual reporting

- Seamless UI/UX for the best customer experience

Performance That Scales Quietly

A scalable system isn't just about handling spikes in user activity, it’s also about maintaining a consistently fast, reliable experience regardless of scale.

Modern platforms are built to handle large volumes of data and concurrent users without slowdowns. Achieving this requires more than good code; it depends on smart infrastructure decisions.

Using cloud-native or hybrid environments, automated performance testing, and regular audits can help avoid bottlenecks that creep in over time. Fast load times and stable uptime may not be flashy features, but they’re what keep clients loyal and what sets apart platforms ready for long-term growth.

In a Nutshell: Performance & Scalability

- Built on a modern, scalable architecture (cloud-native or hybrid cloud)

- Handles high volumes of data and users without lag

- Fast load times and low error rates

- Regular performance audits and optimization

The Advanced Features That Set Leading Platforms Apart

Once your platform has the essentials in place, the next challenge is standing out. The most competitive solutions are shifting focus from simply tracking expenses to actively helping organizations manage spend more intelligently. These advanced features don’t just improve functionality – they create real value for both clients and internal operations.

Smarter Automation and Policy Enforcement

While most platforms support automated approval flows, top-tier systems give users far more control. Advanced rule builders allow organizations to define transaction policies down to the smallest detail, whether that’s spending limits based on department, allowable vendors for recurring payments, or time-based restrictions for high-risk transactions.

The key here is flexibility. Rules shouldn’t be hardcoded or dependent on engineering changes. Instead, platforms should offer dynamic interfaces that let finance teams build, adjust, and deploy rules on their own. Automation also extends beyond approvals; platforms that support bulk actions — like funding, card status changes, or ruleset assignments — can save clients significant time and reduce administrative overhead.

Real-Time Compliance Checks

Manual compliance checks are time-consuming and error-prone. That’s why platforms are increasingly building automated validation into reporting workflows, such as verifying required fields, applying company policy logic, and logging actions for audit readiness. These systems not only reduce support load but also ensure consistency and transparency across every expense report submitted.

AI That Understands Context

As generative AI advances, some platforms are leveraging large language models (LLMs) to power smarter assistants. These tools go beyond basic chatbot functionality. They help users complete complex reports, explain approval logic, and guide them through compliance steps, all using natural language. The result is less friction for users and fewer tickets for support teams.

In a Nutshell: Automation & AI

- AI-powered chatbots for real-time support and guidance

- Automated expense approval workflows with customizable rules

- Smart notifications and spend alerts

- Optical Character Recognition (OCR) for receipt scanning

- AI-driven fraud detection and anomaly alerts

- Auto-categorization of expenses based on history and context

- Spend control by business unit or group - enhances automation and governance by letting admins apply rules and limits by department or team, not just individuals.

Built-In Analytics That Drive Better Decisions

Finance teams today expect more than static reports. They need tools that surface trends, flag outliers, and help prevent problems before they happen. Embedded analytics, especially those tailored to different user roles, are becoming a clear differentiator.

Some platforms have replaced third-party analytics tools with custom solutions that integrate directly with their data architecture. This not only improves performance and consistency but also gives clients control over how insights are displayed and shared.

Data visualization tools like Power BI or Looker are increasingly used to power dashboards that update in real time and support self-service exploration.

What matters most is making analytics accessible. A CFO shouldn’t need to submit a support ticket just to see departmental spend breakdowns. The more you reduce friction in accessing insights, the more value clients will see in your platform.

Smarter Budgeting and Forecasting

Predictive analytics has evolved beyond spotting trends, as it’s now shaping how finance teams plan ahead. Leading platforms are introducing tools that simulate "what-if" budget scenarios, helping organizations anticipate changes in spend behavior and adjust plans in advance. By forecasting future expenses and modeling possible outcomes, platforms can support more strategic, data-informed financial planning.

Procurement Intelligence

Expense management platforms are beginning to provide insights into vendor performance, not just transaction history. These analytics help clients assess supplier reliability, identify cost-saving opportunities, and make smarter procurement decisions. As organizations focus more on spend optimization, this kind of intelligence is becoming a valuable strategic layer.

In a Nutshell: Advanced Analytics & Intelligence

- Custom analytics dashboards tailored by role or department

- Embedded Business Intelligence tools (e.g., Elasticsearch, Power BI)

- Predictive analytics to forecast spend and identify anomalies

- Spend benchmarking against industry standards

Integrations That Power the Whole Ecosystem

Expense platforms don’t operate in a vacuum. They’re part of a larger financial tech stack that includes accounting software, ERPs, productivity tools, and CRMs. The more seamless the connections between systems, the more efficient your clients' operations become.

Modern platforms are offering prebuilt integrations with major accounting platforms, APIs for custom workflows, and even app marketplaces where clients can discover and activate third-party tools on demand. Offering an extensible ecosystem isn’t just about convenience; it’s a strategic advantage that deepens platform stickiness and reduces churn.

Migration tools are also playing a bigger role. Whether helping onboard large clients from legacy systems or moving data between integration versions, these tools can simplify transitions and reduce costly downtime.

In a Nutshell: Integrations & Connectivity

- CRM and ERP integration (e.g., Salesforce, SAP, NetSuite)

- Bank feeds and card integrations (physical, virtual, prepaid)

- Travel software integrations (e.g., Amex GBT, Concur, Navan)

- Payroll and reimbursement systems integration

- App store/marketplace model with user-generated integration requests

- Custom-built migration tools for accounting platforms (e.g., QuickBooks)

- Export tools for niche accounting software

Card Controls That Match Real-World Needs

Offering cards, whether physical or virtual, is just the starting point. What matters more is how much control a platform gives over when, where, and how those cards can be used. High-performing platforms allow organizations to define transaction limits by time, merchant category, location, or even individual cards.

More flexible controls mean organizations can confidently expand card access to more employees while still keeping risk in check. When those controls are tied to dynamic rules and applied in real-time, they not only prevent overspending but also support compliance and audit readiness.

In a Nutshell: Spend Management & Card Controls

- Support for physical, virtual, and vendor-specific cards

- Custom purchase control apps powered by APIs

- Granular spend controls by location, merchant, time of day, amount, or cardholder

- Real-time transaction approvals or declines based on dynamic rules

- Role-based permissions for issuing or managing cards

Ready for Global Teams

Expense management doesn’t stop at borders. To meet the needs of multinational clients, platforms must support multiple currencies, international tax formats, and seamless bank integrations that enable direct reimbursement to employees across different countries.

The best platforms do more than convert currencies. They handle account validation, support alternative payment rails, and automate cross-border reimbursement workflows. With remote teams becoming the norm, global readiness is no longer a luxury; it’s expected.

In a Nutshell: Scalability & Globalization

- Multi-currency and multi-language support

- Global tax compliance tools (e.g., VAT reclaim automation)

- Travel expense management with dynamic per diem rates

UX That Reduces Support Load

Even the most powerful features fall short if they’re difficult to use. The most effective platforms invest in making workflows intuitive for admins, approvers, and spenders. That means offering customizable reporting fields, easy-to-navigate dashboards, and smart defaults that help users avoid errors before they happen.

Advanced platforms are also finding ways to shift more control to users. Whether it’s customizing expense types, adjusting visible fields, or building scheduled reports, giving users more autonomy translates to fewer support tickets and faster adoption.

Live chat modules, export tools, and step-by-step onboarding flows can further streamline the user experience, especially at scale.

In a Nutshell: User Experience & Accessibility

- Mobile-first experience with offline capabilities

- Custom branding and white-label options

- Paperless workflows with cloud document storage

- Employee self-service tools for submitting and tracking expenses

- Budgeting tools with dynamic limits per category/team

Supporting Sustainability Goals

With ESG considerations rising, some platforms are exploring ways to track and report on sustainability-related spending. Features like tagging carbon-intensive purchases, filtering travel types, or generating green expense reports are early signs of this trend. While still niche, eco-conscious expense tracking may become a differentiator for platforms serving purpose-driven organizations.

Final Word: Small Improvements, Big Impact

The best expense management platforms don’t just track spending, they help shape it. From the basics of scalable infrastructure and mobile-first design, to advanced tools like customizable analytics, granular card controls, and global-ready features, each component plays a role in reducing operational costs and improving the user experience.

If you’re already offering many of the features we’ve outlined, that’s a strong sign you’re headed in the right direction. But even well-established platforms can benefit from periodic reevaluation.

Are your rules flexible enough for large clients with unique workflows? Are analytics accessible and meaningful, or just checking a box? Is your infrastructure optimized to support rapid growth without added complexity?

The expense management space is evolving quickly. Looking to enhance your platform’s performance or explore new features? Let’s talk about what’s next for your expense management solution – We’re always happy to share what we’ve learned.