Our Fintech Integration Experience

With 15+ years of experience supporting fintechs, banks, and expense management platforms, we know how to architect integrations that unlock revenue, accelerate development, and strengthen compliance – while keeping user experience at the center.

Softjourn helps financial platforms integrate with the services and tools that power growth, security, and customer satisfaction. Whether you’re building a banking product, an expense management tool, or a lending platform, we support integrations across the entire financial ecosystem:

Connect with the providers that will power your growth — from KYC and card issuing to payments and accounting.

Results You Can Expect

Whether it’s adding card issuing, KYC, or open banking, integrations reduce time-to-market so you can roll out new offerings without overhauling your core system.

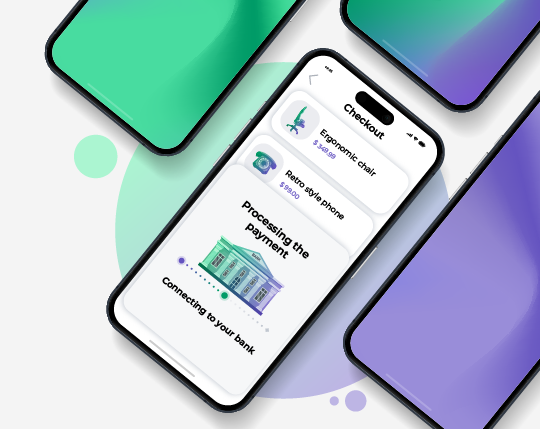

Integrations with identity verification, fraud scoring, and decision engines streamline the user journey — reducing drop-offs and speeding up approvals.

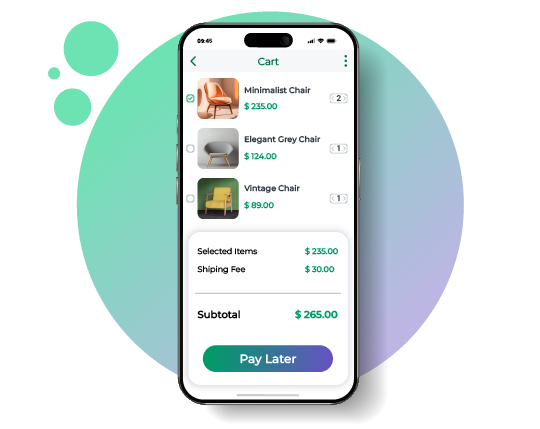

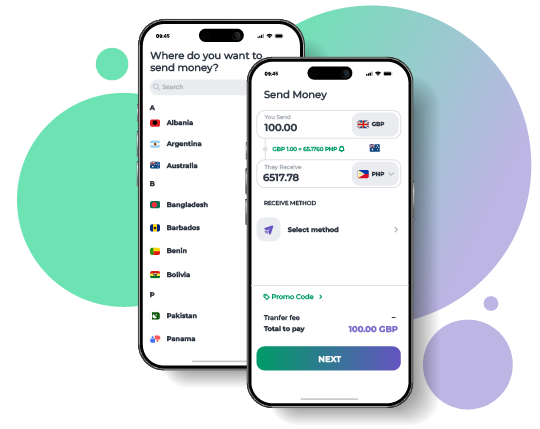

By connecting to BNPL providers, digital wallets, and alternative payment methods, platforms unlock new transaction flows and serve a broader audience.

Back-office integrations eliminate manual tasks like reconciliation, compliance reporting, and data exports — freeing up time for higher-value activities.

Our secure, auditable integration frameworks help platforms meet evolving KYC, AML, PCI-DSS, and regional compliance requirements.

With well-structured APIs and middleware, you can easily connect new partners or swap vendors — without redoing your entire infrastructure.

Want to learn more about how we can support your next fintech integration? Let’s connect.

How We Deliver Seamless Fintech Integrations

Our Fintech Case Studies

Benefits of Working With Softjourn

Accelerated Time-to-Market

Proven Scalability & Security

Reduced Costs & Integration Risks

Enhanced User Experience

Flexible Engagement Models

Regulatory Confidence

Explore real-world case studies where Softjourn helped fintechs accelerate growth, strengthen compliance, and deliver new features faster.

Some of the Integrations We Support

We’ll help you integrate with the right tools to improve onboarding, reduce risk, and scale with confidence.

Engagement Models

What Services We Offer

From architecture audits to integration roadmaps, we help clarify your requirements, reduce technical risk, and define the right path forward — saving you time and budget. Discover more about our Fintech Consulting.

Explore innovative fintech solutions before committing to full development. We’ve built AI-powered assistants, blockchain prototypes, custom card-issuing flows, and more. Learn more.

We design intuitive financial experiences — from onboarding and KYC to dashboards and payment flows — aligned with your brand, users, and compliance needs. Explore further into Softjourn's Digital Product Design Services.

We specialize in integrating fintech platforms with the services that matter — from card issuing and KYC/AML to open banking and payment processing. Learn more about our integration services.

Build scalable, secure solutions tailored to your business model — including integrations with banks, processors, BaaS providers, and payment gateways. Get to know more about Softjourn's Software Engineering Services.

Our QA team ensures your platform runs smoothly and securely under real-world financial use cases — from performance and compliance to user experience. Explore further into Softjourn's QA services.

Stay ahead of platform changes and evolving fintech regulations with ongoing support, monitoring, and feature enhancements for your live applications. Get to know more about Softjourn's Application Support and Maintenance Services.

Our technology stack at Softjourn is designed to empower us to deliver world-class services to our clients. With a strong focus on innovation and efficiency, we continually adapt our expertise to stay ahead of the curve. Discover the Technologies and Frameworks we utilize, and learn how we can bring your ideas to life.

Technology Expertise

Softjourn is a software development company with deep expertise in fintech, helping financial institutions and platforms build innovative solutions tailored to their unique needs. With nearly two decades of experience in payments, expense management, and banking systems, we provide clients with strategic consulting, development roadmaps, and high-performance applications.

Our experts know how to design and deploy secure financial applications, integrate with critical third-party services, and modernize legacy systems — enabling clients to stay compliant, scalable, and competitive in a rapidly evolving industry.

Client Testimonials

Tacit Corporation selected Softjourn for their custom event ticketing solutions due to their technical expertise and direct approach. Brenda Crainic, CTO of Tacit, highlighted, "Our Softjourn team developed and helped us certify most of our integrations with over 60 third-party systems, such as Point of Sale, payment gateways, loyalty and gift cards, players cards, student cards, lockers and most recently, autonomous stores.

Our team’s dedication to understanding Tacit's needs has been instrumental in enhancing their platform’s capabilities, ensuring robust solutions. This ongoing collaboration underscores our commitment to delivering high-quality, innovative services that support our clients' visions." - Brenda Crainic, CTO and Co-Founder of Tacit

Fintech Integrations FAQ

We cover the full fintech ecosystem: payments, card issuing, KYC/AML, BaaS, open banking, lending, accounting, cross-border payments, FX, and more.

We’re tech-agnostic and have experience with a wide range of systems — including cloud-native apps, microservices, legacy platforms, and mobile/web apps across AWS, Azure, and more.

The best time is during platform planning or when expanding your feature set. Early integration planning ensures smoother architecture, reduces rework, and speeds up time-to-market.

You can — but it depends on your team’s experience. Many fintech integrations involve complex flows, compliance risks, and platform nuances. Our team helps you avoid pitfalls and deliver faster, more secure implementations.

Faulty or incomplete integrations can cause delayed transactions, failed KYC checks, reconciliation errors, and even compliance breaches. We help ensure your integrations are robust, secure, and audit-ready.

Yes. We can integrate modern APIs with legacy systems, or design middleware layers to bridge architectural gaps. We’ve done this for banks, fintech startups, and enterprise platforms.

Absolutely. We build for scale — using cloud-native architectures, asynchronous processing, and performance testing to ensure stability during high-traffic periods like product launches or reporting cycles.

It varies. Simple integrations may take 2–4 weeks, while more complex ones involving multiple services, compliance checks, or legacy platforms may take longer. We provide clear timelines after a brief scoping call.

We monitor API changes and build version-aware integrations. If you choose our maintenance package, we’ll handle updates proactively to avoid disruption.

Yes — whether you need a dashboard, reporting module, or a custom UX flow to accompany the integration, our team can handle full-cycle development alongside the connection itself.

Pricing depends on complexity, timeline, and your engagement model (T&M, Fixed Bid, or Dedicated Team). We’re happy to provide an estimate after understanding your requirements. Contact us to learn more.