The payments industry is constantly evolving and 2025 is shaping up to be a year of significant innovation and change. The more seamless payments become, the more complex they grow behind the scenes.

While consumers tap, scan, and voice-command their way through transactions in seconds, the infrastructure powering these experiences has become a sophisticated ecosystem of machine learning algorithms, blockchain networks, and real-time risk assessments. We predict that this year, the biggest players in the fintech industry will focus on making payments more convenient, secure, and personalized for consumers.

At Softjourn, we’ve spent years developing and integrating cutting-edge payment solutions, helping fintechs, banks, and businesses stay ahead in an evolving financial landscape. With the payments industry rapidly transforming due to new technologies, regulations, and customer expectations, staying informed is crucial.

We will discuss all the latest trends in the payments industry for 2025 and the key topics influencing change in business and payment practices, ranging from the increasing popularity of cryptocurrencies and the emergence of digital wallets to the growing significance of data security and the developing role of artificial intelligence.

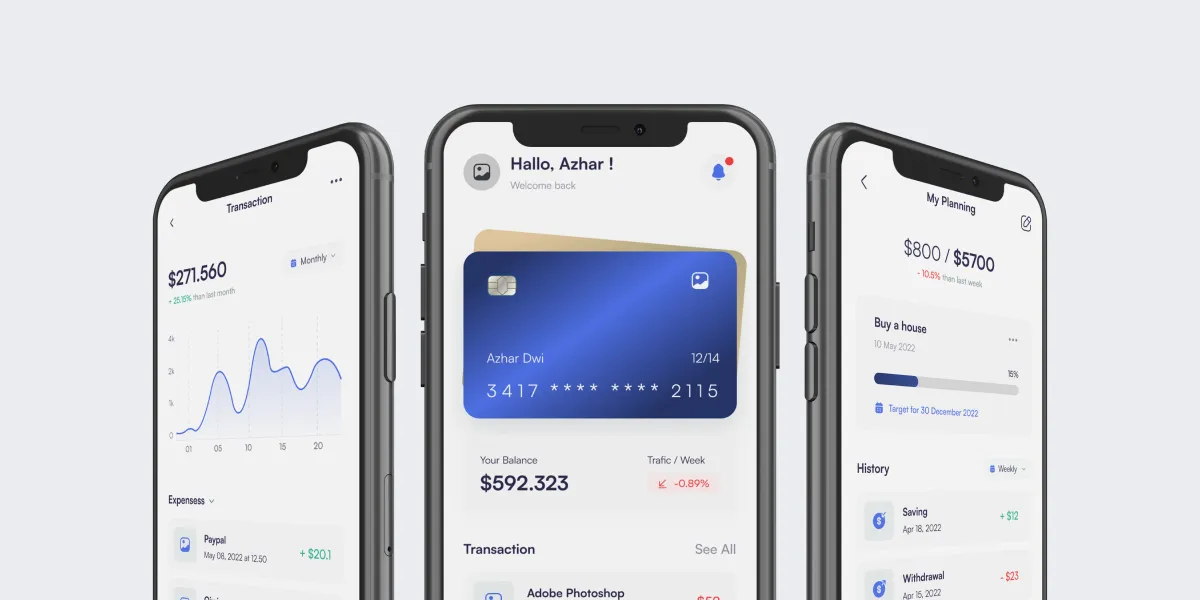

1. The Increasing Demand for Personalization in Payments

In the evolving landscape of payments, the emphasis on personalization remains a pivotal trend anticipated to define the year 2025.

Driven by consumer demand for tailored experiences, businesses are recalibrating their payment processes. This shift aims to seamlessly integrate payments with consumer purchases, optimizing operational efficiency, enhancing privacy, and ultimately elevating customer acquisition. The payment landscape has become a critical battleground for customer retention, with recent research from PYMNTS Intelligence revealing that payment flexibility has a direct impact on purchasing decisions for the vast majority of online consumers. According to their report, 70% of online shoppers will abandon their purchase if they cannot pay using their preferred method

The growing significance of customer-experience transformation can be achieved by hyper-personalization. As businesses leverage data-driven approaches, the focus on individualized customer journeys in finance becomes paramount.

The accessibility of item-level data acts as a catalyst, enabling highly tailored payment experiences that resonate with consumers on a deeper level. This trend isn't solely about making payments convenient; it's about creating a seamless, user-centric approach that aligns with evolving consumer preferences.

Payment processors and neobanks that effectively implement personalization strategies stand to differentiate themselves in a crowded marketplace and build stronger, more enduring relationships with their customer base.

These advancements in personalization aren't just a shift in the payments landscape; they signify a fundamental transformation in how businesses interact with and cater to their Millenial and Gen Z’s customers' needs.

2. A2A Payments Will Drive Profits

The surge in account-to-account (A2A) payments is poised to revolutionize the global payments landscape in 2025.

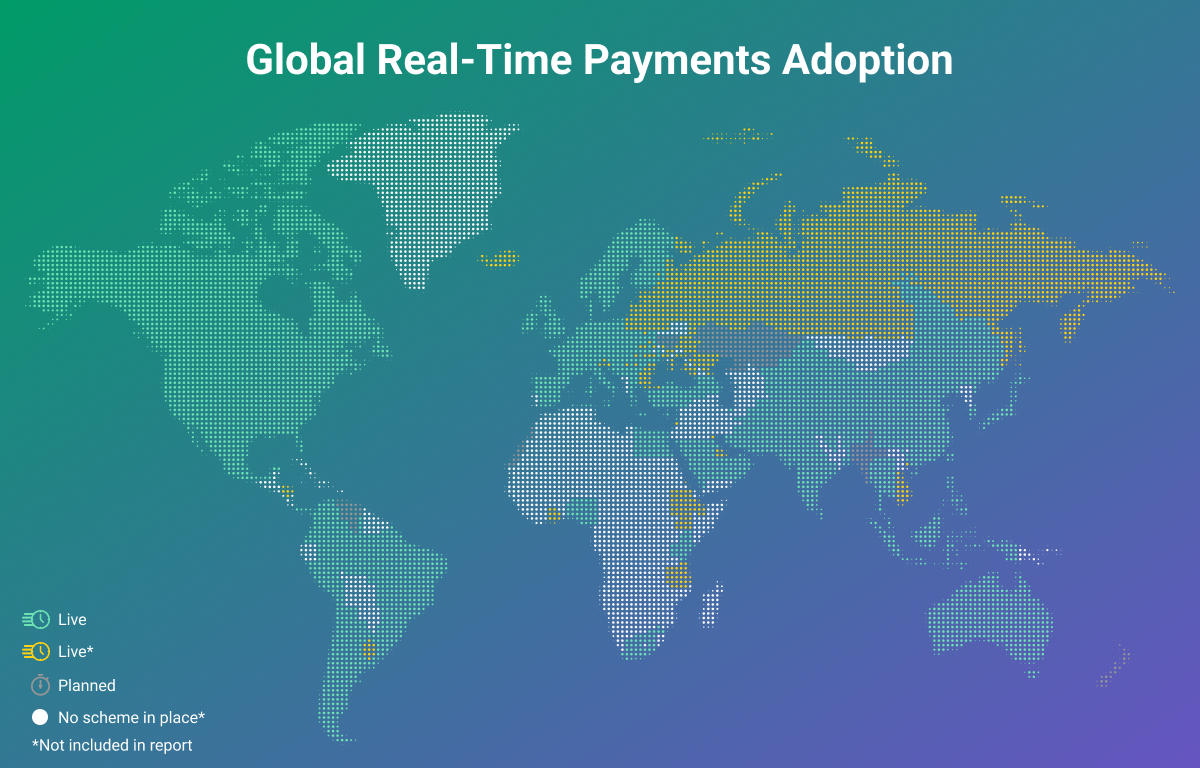

While Western markets predominantly rely on digital wallet proxies like Apple Pay and Google Pay, emerging economies such as India, Brazil, and China are spearheading the growth of A2A payments through the adoption of open banking, instantaneous transactions, and robust merchant support. This trend is driven by the promise of faster, cheaper, and more secure transactions, appealing to consumers and businesses alike.

The evolution of instant payments and the support of merchants are catalysts propelling A2A payments' popularity. Instantaneous transactions align with the modern consumer's demand for immediacy, while merchant support amplifies their adoption, the problems occur when bank digital transformation fails or when their infrastructure is less developed.

In 2025, the U.S. payments landscape is expected to see significant growth in pay-by-bank services, driven by several factors:

Growing availability of real-time payment rails: The launch of the Federal Reserve's FedNow instant payments service and the Real Time Payments network of The Clearing House will contribute to the growth of account-to-account (A2A) payments.

Increased interest from businesses: Businesses are seeking to avoid card processing fees and gain faster access to funds, driving the adoption of pay-by-bank services.

Increasing democratization of payments: The shift towards more accessible and user-friendly payment solutions will encourage more consumers to adopt pay-by-bank services.

The trajectory of A2A payments is set to influence cross-border and business-to-business transactions. The growing conversation among regulators and the deployment of pilots in 2024 established a solid foundation for the substantial growth expected in 2025.

Juniper Research has found that the value of global transactions via Account-to-Account payments (A2A) will rise from $1.7 trillion in 2024 to $5.7 trillion by 2029; increasing by 230%, solidifying A2A payments' pivotal role in the financial landscape.

By late 2025, hundreds more banks and payment service providers are expected to launch account-to-account faster payment capabilities, urged on by merchant sensitivity around card fees and banks delivering payment solutions to complement open banking.

Action Item

There are several monetization models for mobile payment apps, including charging for premium features, transaction fees, and affiliate marketing. Micro-payments, in-app purchases, membership fees, and selling source codes and APIs can also be effective monetization strategies. The best approach will depend on the specific app and target audience.

To successfully develop a payment application, you must ensure that the system supports a variety of payment methods, such as peer-to-peer within the network, e-commerce, and on-the-spot transactions at retailers. It should also be versatile, scalable, and able to handle high loads without crashing.

Consider geographical regulations and dispute resolution processes, as well as real-time currency conversion for peer-to-peer systems. Native apps may also be beneficial for e-commerce sites to enable faster payment processing.

When building a money transfer app, it is important to consider the financial regulations in the target market. This includes PCI-DSS compliance and the laws set by individual states or countries the app caters to.

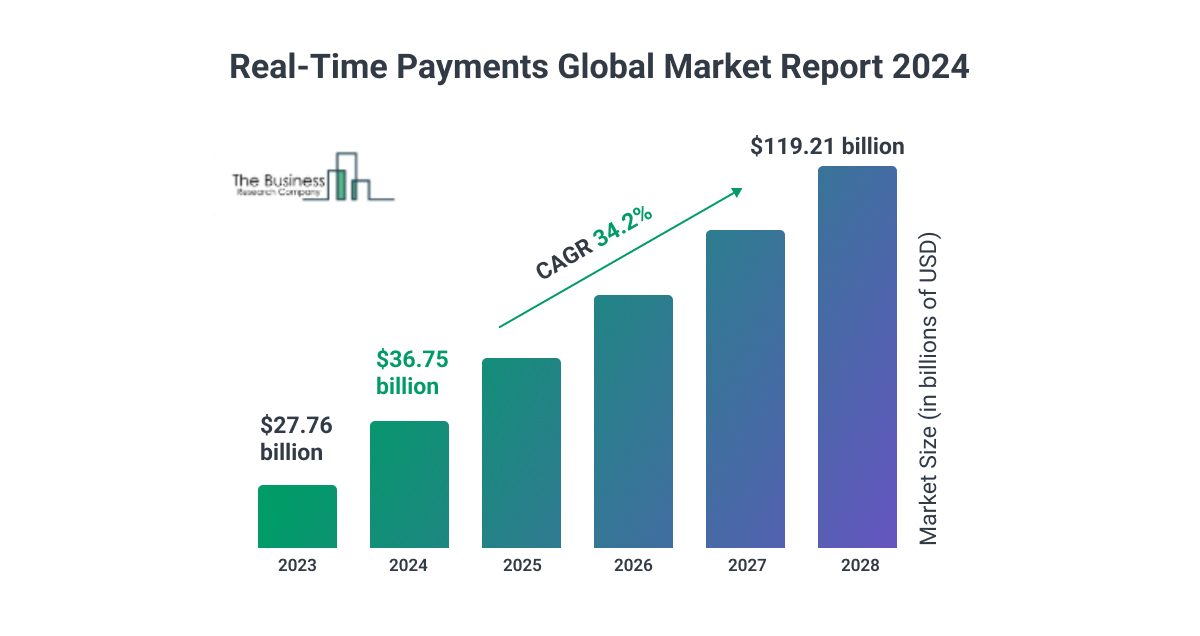

3. Automated Software Will be Used to Secure & Optimize Transactions

The Real-Time Payment market size is projected to grow from $12.30 billion in 2024 to an impressive $114.94 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 32.23% during the forecast period (2024 - 2032).

New payment rails enable faster, more efficient real-time payments for B2B transactions, which will continue to have a transformative effect on businesses. Plus, the global implementation of the ISO 20022 messaging standard will have a positive effect on real-time cross-border payments and will enhance security and compliance around the world.

The US government has introduced the FedNow payment service, launched in 2023, designed to offer customers next-generation, innovative, and instant payment capabilities. As a result, banks are expected to take strategic steps to modernize their infrastructure, ensuring the flexibility needed to support real-time payment types and seamlessly integrate with this evolving ecosystem.

In 2025, we believe companies will be using a combination of efficient but expensive real-time payments, and cheap but slow ACH transfers. We recommend using algorithms that can calculate the best and cheapest systems and providers to use, depending on your transaction needs.

Other software, like payment gateways, will also be widely utilized and sought after in 2025. A payment gateway is a software application that allows merchants to securely process, verify, and accept or decline payment transactions on their websites or mobile apps. It acts as an intermediary between the merchant's website or app and the payment processing network of the merchant's acquiring bank, enabling customers to make online payments using their credit or debit cards.

Building a payment gateway can be beneficial for businesses because it allows them to offer their customers a convenient and secure way to make online payments. It also simplifies the payment process by automating the handling of transaction approvals and declines and can help businesses reduce their fraud risk and grow their revenue.

Having a payment gateway can make it easier for businesses to integrate with other payment services and systems, such as payment processors and payment orchestrators. Payment services can automate the optimization of transaction approvals, which can help increase revenue and improve customer relations.

Action Item

To build a payment gateway, you will need to partner with a payment processor and acquiring bank. The payment processor will provide technical specifications for integrating your gateway with their system, and the acquiring bank will provide a merchant account to accept digital payments.

It can cost between $200,000 and $250,000 to build a minimum viable product (MVP) for a payment gateway, and it may take several months to years to develop the gateway from scratch.

Alternatively, you can license a white-label product, which can be up and running in a few months, or you can use an open-source solution, which may take less time but requires more development and technical expertise.

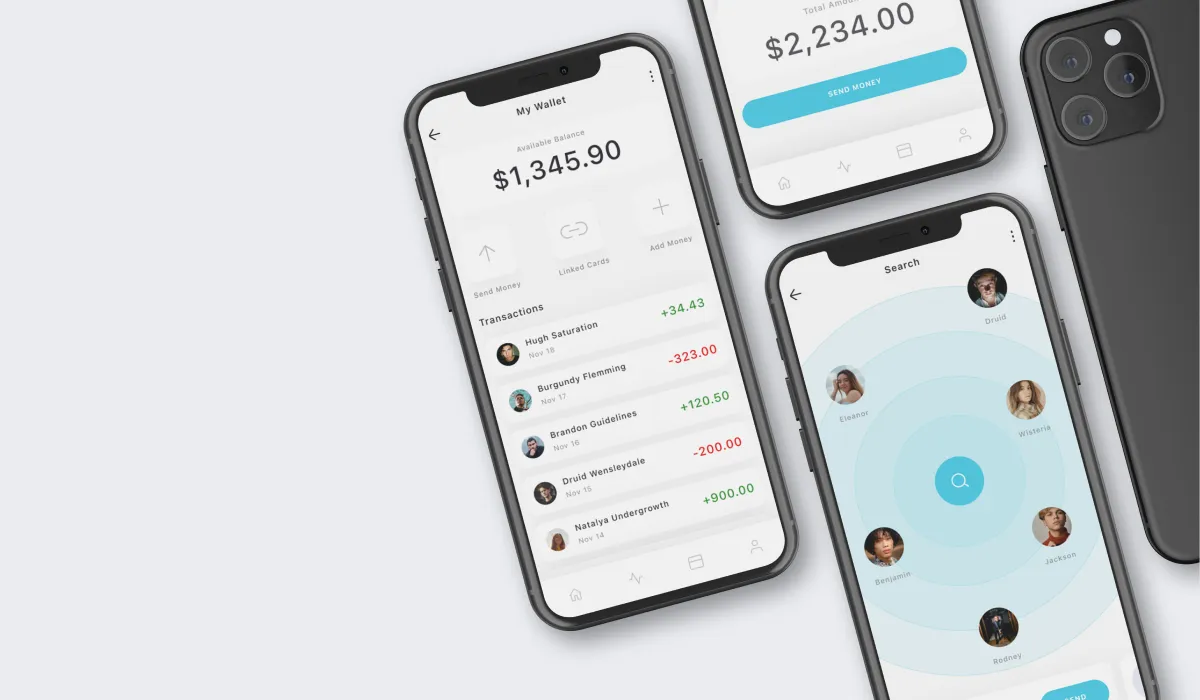

4. Digital Wallets Attract Record Number of Users

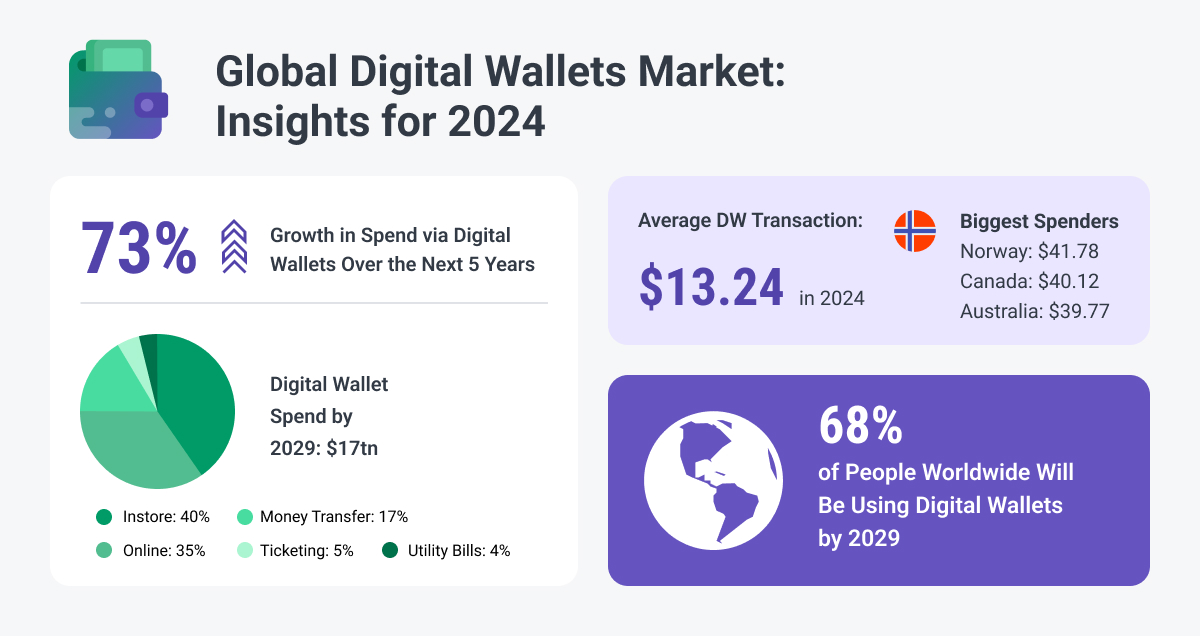

The proliferation of digital wallets continues its upward trajectory, transcending traditional payment boundaries to encompass digital identity management. The forecasted exponential growth in digital identity apps globally hints at a paradigm shift set to unfold in 2025, catalyzing widespread adoption in the EU and beyond.

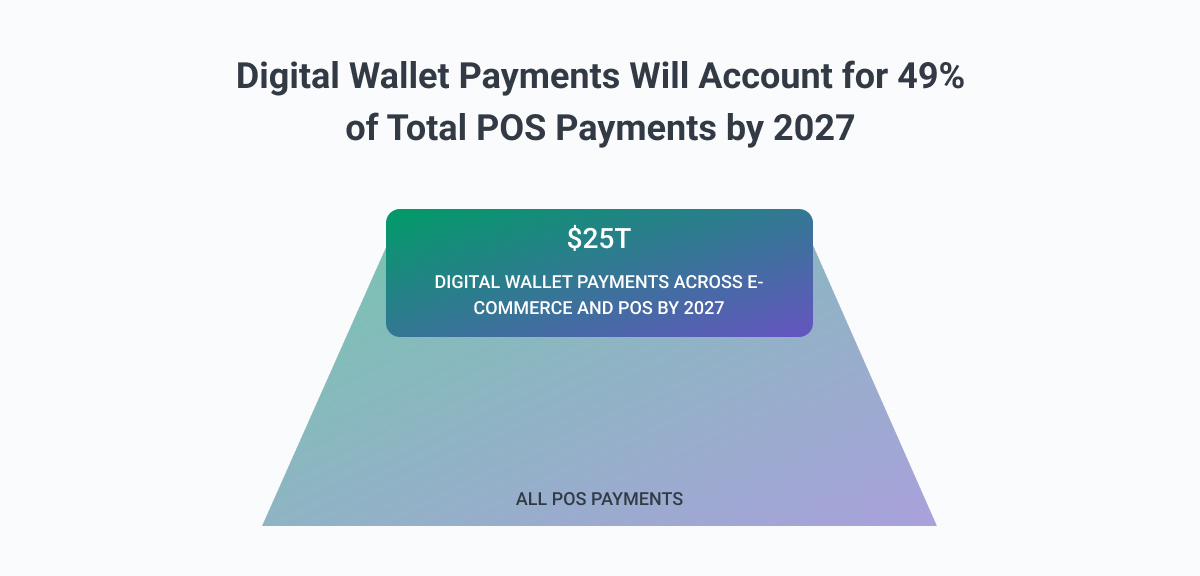

Worldpay projects further dominance of digital wallets in e-commerce by 2027, with digital wallets increasing their share of transaction value to 52%, and credit and debit cards falling to 22% and 12%, respectively.

Globally, digital wallets already secured the top spot for share of POS transaction value, the same report said. Wallets accounted for 30% of POS spending last year, compared to credit and debit cards at 27% and 23%, respectively. And by 2027, wallets are projected to account for 46% of that spending, about $19.6 trillion, more than credit and debit cards combined.

The integration of digital identities into everyday transactions marks a significant leap in the payments processing landscape. Initiatives like the EU ID Wallet (eIDAS2) and Apple's integration of digital driving licenses into its Wallet app are pivotal steps toward seamless integration. This trend extends beyond payment transactions, offering users a centralized hub for storing credentials and identity attributes.

The convergence of digital wallets and identity solutions symbolizes a transformative shift in how individuals interact with digital platforms, promising enhanced security, convenience, and a more integrated user experience.

We predict that not only will digital wallets increase in use and popularity, but that companies will continue adding innovative features to incentivize and persuade consumers to select their e-wallets, while ‘super apps’, like Paypal, will continue expanding their offerings.

David Barrett, the CEO of Expensify, spoke to Softjourn about the connection he sees between payments and the integration of communication features:

“Payments and chat are fundamentally the same things; every payment is a structured chat to resolve some kind of debt tension between two people. There is a spectrum of functionality between freeform chat and expense management, and every form of payment is somewhere on that spectrum.”

Barrett believes that it’s time for expense and other platforms to step up their game by adding communication features - like Slack, SMS, or WhatsApp - but optimized for financial conversations at work and between friends.

Action Item

When we advise clients on building a digital wallet, we suggest they do the following:

- Research the market to understand the needs and preferences of potential users.

- Choose the technologies that will be used to transfer payment information and complete transactions. These may include NFC, Bluetooth, and QR codes.

- Implement security measures such as point-to-point encryption, tokenization, and password protection to ensure the safety of users' payment information.

- Design the user interface and user experience (UI/UX) to be simple and intuitive. This will make it easy for users to navigate the app and use its features.

- Develop additional features that will make the app more useful and appealing to users, such as loyalty rewards, bill splitting, and push notifications.

- Test the app to ensure that it functions correctly and all security measures are in place.

- Launch the app and promote it to potential users.

- Continuously improve the app based on user feedback and market trends. This may involve adding new features, improving existing ones, and addressing any technical issues.

To build a successful digital wallet, we recommend collaborating with a reliable software development partner with expertise in the payments industry. This will help ensure that the app meets the needs of users and stands out in a competitive market.

5. The Emergence of Web 3.0 in Payments

Web 3.0 is the third generation of web technology, which focuses on the integration of structured data and intelligent services to enable the web to understand and fulfill user intentions. In the context of payments, Web 3.0 can be used to enable more intelligent and personalized payment experiences for users.

For example, Web 3.0 technologies can be used to enable users to make payments using natural language processing (NLP) and voice commands, allowing them to simply tell their device what they want to pay for and how much they want to pay. Web 3.0 technologies can also be used to enable more personalized payment recommendations and offers based on a user's past payment history and preferences.

Additionally, Web 3.0 technologies can be used to enable more transparent and secure payment processes, using technologies such as blockchain and smart contracts. These technologies can be used to create immutable, decentralized payment networks that allow for secure and transparent tracking of payment transactions.

The current cross-border payment system has issues with intermediaries, long transaction routes, and lengthy screening processes, causing delayed payments. Web 3.0 technology will improve this by connecting global banks and making the system more efficient, affordable, and interoperable, resulting in simpler liquidity management and treasury operations.

However, blockchain-based FinTech providers face challenges in accessing "off-chain" financial data, such as open banking information. Known as the "API connectivity problem," this disconnect fuels the misconception that DeFi can fully replace centralized finance.

The API3 foundation addresses this gap by integrating open banking with Web 3.0, enabling the creation of advanced financial solutions that bring the principles of open banking to the blockchain. API3 achieves this through secure, decentralized oracle data feeds powered by top-tier API providers worldwide.

Web 3.0 technologies have the potential to enable more intelligent, personalized, and secure payment experiences for users. While these technologies are still in the early stages of development and adoption, we predict that they will be more widely used in the coming years, and are a payment trend that might be worth considering for early adopters.

Action Item

If your fintech business is looking to implement blockchain and Web 3.0 technology, look no further than Softjourn. Our team of experts has extensive experience in implementing innovative technologies for fintech businesses, helping them to drive innovation and deliver enhanced payment experiences for their customers.

6. The War Against Cybercrime Continues in 2025

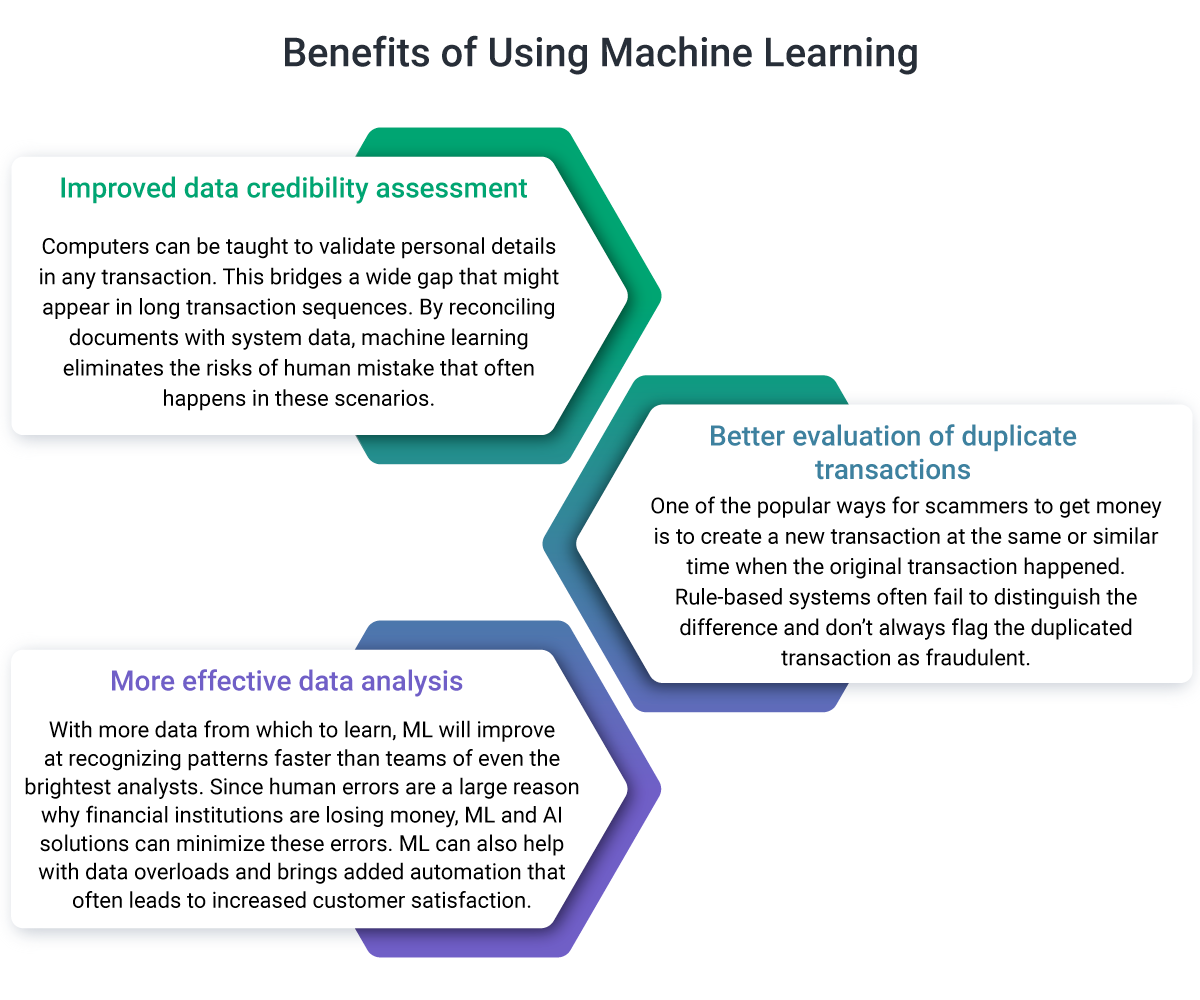

With the rise of digital payments comes heightened concerns about cybersecurity. Financial institutions are intensifying their efforts to combat cyber threats with ML and AI and protect customer trust. Technologies such as tokenization, machine learning, and advanced encryption are being deployed to fortify digital payment ecosystems against potential vulnerabilities.

The imperative to safeguard sensitive information has never been more critical, given the financial sector's escalating cost of data breaches. The proactive adoption of robust cybersecurity measures is imperative to mitigate the risks associated with cyber-attacks.

The need for a collaborative approach between industry stakeholders to tackle cyber threats is gaining prominence. With the average cost of data breach worldwide is $4.88 million, according to Statista, banks will continue to invest in technologies able to fight cybercrime in 2025.

The fight against cybercrime isn't merely a reactive measure but an ongoing commitment to fortifying the infrastructure supporting digital transactions, ensuring the integrity and security of the payment ecosystem.

For example, in the past years, Revolut set itself apart with its award-winning fraud prevention. They use a combination of facial recognition and other biometrics, PIN codes, and SMS for login, as well as utilizing payment security such as single-use virtual disposable cards, temporary card freezes, and an automated security system.3

The adoption of encryption technologies expanded significantly in 2024. Key findings from a recent report highlight:

- Formal Cryptographic Programs: 71% of organizations have established formal cryptographic programs, with half of them implementing well-defined policies organization-wide.

- Increasing Encrypted Data: 68% of organizations are encrypting sensitive cloud-based data to bolster security.

- Rising Security Budgets for Encryption: Nearly 75% of organizations have allocated budgets for encryption technologies, with another 20% expected to follow in 2024.

In 2025, we will see more companies in the fintech industry implementing Machine learning (ML) and Artificial Intelligence (AI) to prevent payment fraud. By analyzing past data and developing a mathematical model to determine normal user behavior, ML helps financial institutions monitor customer spending habits and detect any unusual activity, without inconveniencing the customer with additional verification steps.

The main trend we will see in 2025 is going to be the widespread implementation of artificial intelligence in various areas of fintech and banking. AI will be actively used in customer support, compliance, personalization of services, and automation of many processes. This will significantly reduce operating costs, allow to combat the shortage of specialists in a number of areas, and help make fintech companies more efficient.

AI and machine learning will transform client profiling, fraud monitoring, investment recommendations, and portfolio optimization, enhancing operational efficiency, particularly in back-office operations and customer service.

There will also be an increase in unified digital lending platforms for member-centric loans. AI and no-code will allow credit unions to create digital lending platforms that offer members a seamless loan application experience, from pre-qualification to approval. In 2025, unified platforms will enable credit unions to compete with FinTechs by offering fast, personalised loan experiences that can adapt to each member’s financial situation.

In payments, the proliferation of AI will continue to improve user experience and increase security. To detect fraud, AI is used to track patterns and payment flows in real time. If unusual activity is detected, the technology can be used to flag or even block payments which may be fraudulent.

Ireland-based Encryption-as-a-Service company Vaultree has continued to innovate since raising $12.8 million to develop the first fully functional data-in-use encryption.4 As of 2025, Vaultree's end-to-end encryption technology is setting a new standard in industries like finance, healthcare, and cloud computing, where securing sensitive data is paramount. This year, Vaultree is revolutionizing the field of encryption with a focus on encrypted Machine Learning (ML), Artificial Intelligence (AI), and Fully Homomorphic Encryption (FHE).

Action Item

There are a number of ways that businesses can prevent digital payment fraud. Some of the key measures that businesses can take include implementing strong security measures, such as:

- Encryption

- Two-factor authentication

- Tokenization

- Regularly monitoring for suspicious activity

- Responding quickly to any potential threats

- The use of digital IDs

- Utilization of ML for fraud detection

Additionally, businesses can work with payment service providers and other partners who have experience in preventing and detecting payment fraud to help identify and mitigate potential risks.

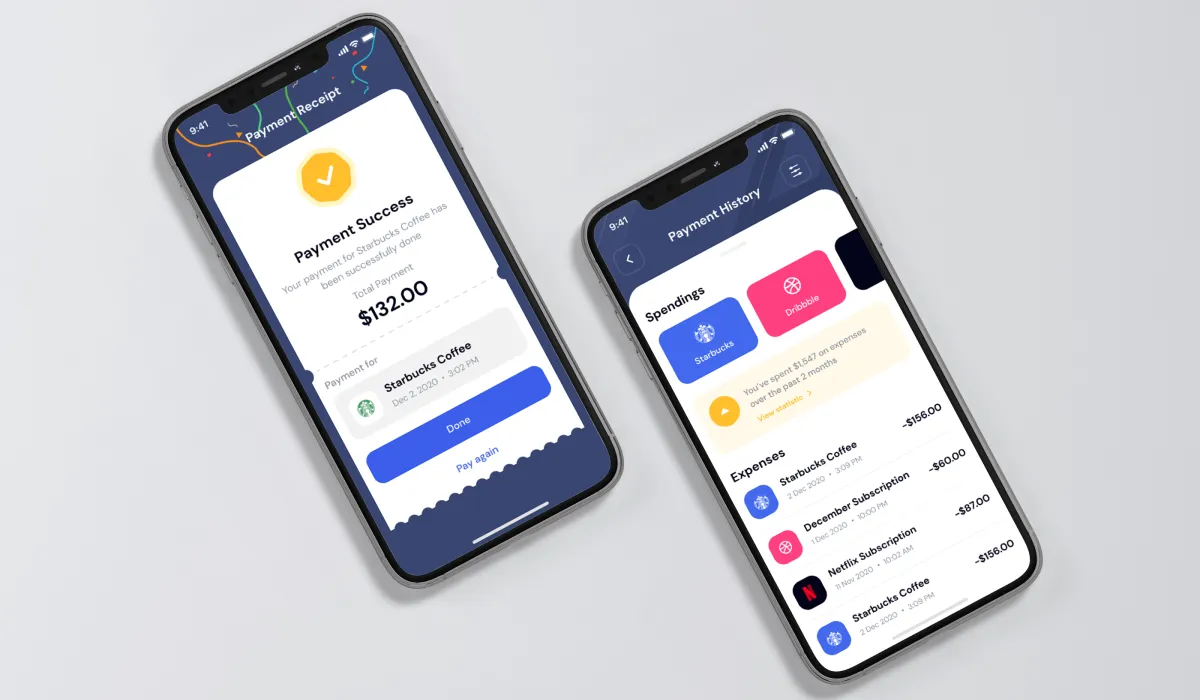

7. Buy Now, Pay Later (BNPL) Continues to Allow More Spending Across Markets

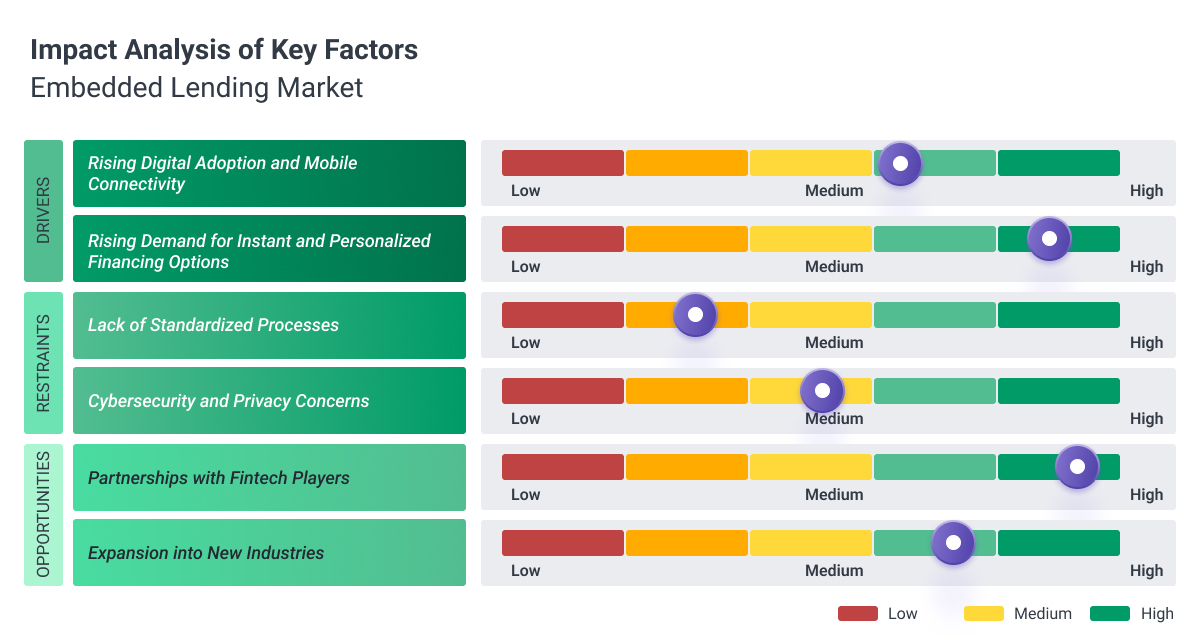

Companies are embracing embedded lending as one of the newest fintech strategies for business growth.

According to Future Market Insights, the embedded lending market is projected to experience remarkable growth, expanding at a CAGR of 19.6% over the forecast period. The market value is expected to surge from $7.7 billion in 2024 to an impressive $45.7 billion by 2034, highlighting the rising demand for integrated financial solutions across industries.

The major market players are highly investing in research and development to improve the technical features of BNPL systems. Industry players have attempted several strategic initiatives, including supplying varied product ranges, joint ventures, mergers, acquisitions, and collaborations. These tactics help firms and market players to gain a stronger presence in the global BNPL market.

Buy Now, Pay Later (BNPL) has transcended its origins to become a cornerstone of consumer payments, with 2025 to witness its further evolution and integration within the financial landscape.

The appeal of BNPL for consumers lies in its convenience and accessibility, enabling immediate access to purchases while deferring payments over subsequent weeks or months.

During the COVID-19 pandemic, BNPL experienced a surge, capturing the attention of consumers seeking flexible payment options and managing expenses amidst economic fluctuations.

Younger consumers, particularly Millennials and Gen Z, are driving the adoption of BNPL services. A 2024 study by PYMNTS reported nearly 50% of Gen Z and 47% of millennials have used BNPL in the past 12 months. PYMNTS also found that paycheck-to-paycheck consumers are more than twice as likely as non-paycheck-to-paycheck consumers to use BNPL.

What distinguishes BNPL is its appeal across diverse consumer segments, extending beyond millennials and Gen Z to encompass a significant portion of shoppers. Recent holiday shopping season data showed U.S. shoppers spent $16.6 billion dollars using BNPL plans, with BNPL volume increasing 14% year-over-year.

Companies, too, have recognized the significance of BNPL in driving sales and enhancing customer engagement. From retail to e-commerce, businesses leverage BNPL to augment basket sizes, close sales, and cater to consumer preferences for flexible payment structures.

The market's competitive landscape witnesses a multitude of players vying for market share. Dedicated BNPL providers, banks, tech giants like Apple, and other financial institutions have entered the fray, intensifying competition and spurring innovations within the BNPL space.

2025 is anticipated to mark a pivotal phase in BNPL's trajectory. Regulatory scrutiny, concerns regarding responsible lending, and data privacy issues loom on the horizon, prompting industry stakeholders to navigate a potentially more regulated landscape.

BNPL providers are ready to innovate further, diversify their offerings, and extend their services into brick-and-mortar commerce. Apple's introduction of Apple Pay Later exemplifies the potential disruptions within the market, foretelling a future where seamless digital wallet integration becomes the norm.

As companies and consumers continue to embrace BNPL's flexibility and accessibility, its role in reshaping payment behaviors remains pivotal.

The rise of B2B BNPL is a transformative trend in the business financing landscape. It's not just about offering another credit option; it's about rethinking how businesses manage their finances to better align with their specific needs and the challenges of the modern economy. The trend reflects a broader shift towards more personalized, flexible, and digital-first financial solutions in B2B.

Updates to BNPL

The upcoming Consumer Credit Directive 2 (CCD2) will significantly reshape how BNPL services operate across Europe. Expected to take effect by late 2026, the directive classifies BNPL as credit, meaning providers must now comply with APR caps, conduct creditworthiness checks, and improve transparency around terms and costs. This could drive up operational costs and force changes to pricing models or eligibility criteria, particularly challenging in cross-border markets where APR limits vary by country.

Source: Consultancy.eu, “EU retailers offering Buy Now Pay Later must comply with new CCD2 rules,” April 23, 2025.

Action Item

As payments become digitized, old payment methods are reappearing. Consumer financing goes beyond loans with high-interest rates and credit cards. Fintech platforms, FI, and payment gateways offer flexible payments as consumers shift from traditional to online shopping..

There are several perks to having for your business:

- Higher conversion rates

- Greater Average Order Value (AOV)

- More customer insights

- Fewer abandoned carts

- More repeat business

Staying at the forefront of the financial industry is only possible through regular innovation. Softjourn has developed BNPL solutions for our clients, enabling them to offer BNPL to their brick-and-mortar, m-commerce, and e-commerce merchants.

During our collaboration with our client, UPC, we created an attractive BNPL solution for their existing and new clients, providing their customers with less risk of a chargeback, more choices of installment payment plans at checkout, and payment methods that would suit the budget of their customers.

8. AI Revolutionizes AML Tools for Enhanced Regulatory Compliance

Research and Markets forecasted a surge in global spending on regulatory technology to $35.4 billion by 2029, heralding a significant paradigm shift in the financial landscape.

Despite continuous strides in digitalization, many banks grapple with the intricate web of regulatory requirements. The advent of new technologies, particularly Artificial Intelligence (AI), promises to revolutionize Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) compliance, making processes cost-effective and more efficient.

Integrating AI-driven solutions in AML tools presents an opportunity to streamline cumbersome compliance procedures. These technologies are set to simplify and fortify Customer Due Diligence (CDD) and Know-Your-Customer (KYC) processes, augmenting human performance, and swiftly responding to emerging threats. This augmentation expedites compliance efforts and bolsters accuracy and efficacy in detecting suspicious activities.

The evolving landscape demands a proactive stance, prompting AML vendors to pivot toward developing advanced AI-powered systems. Another successful way to ensure compliance in finance is to conduct regular code audits to ensure compliance with the latest regulations.

AI's transformative impact extends beyond automating routine tasks:

- it encompasses the capacity to analyze vast datasets

- identify intricate patterns

- adapt to evolving risk landscapes

Furthermore, the integration of AI in AML tools offers a cost-effective solution, reducing operational overheads while enhancing compliance efficiency. The ability to swiftly detect anomalies and potential risks significantly minimizes potential financial losses associated with non-compliance.

The collaboration between AI technologies and human expertise represents a formidable alliance in the fight against financial crimes. By empowering human analysts with AI-driven insights, institutions can optimize their resources, redirecting focus towards more complex investigative tasks while AI handles routine processes.

In essence, the convergence of AI and AML tools symbolizes a critical juncture in the financial industry's evolution.

The anticipated focus on developing more advanced AI-powered systems in 2025 signifies an unwavering commitment towards harnessing technology to fortify regulatory compliance efforts. As financial institutions embrace these innovations, they pave the way for a more secure, efficient, and compliant financial ecosystem, ensuring integrity and trust in global financial transactions.

Other Trends to Keep an Eye On in 2025

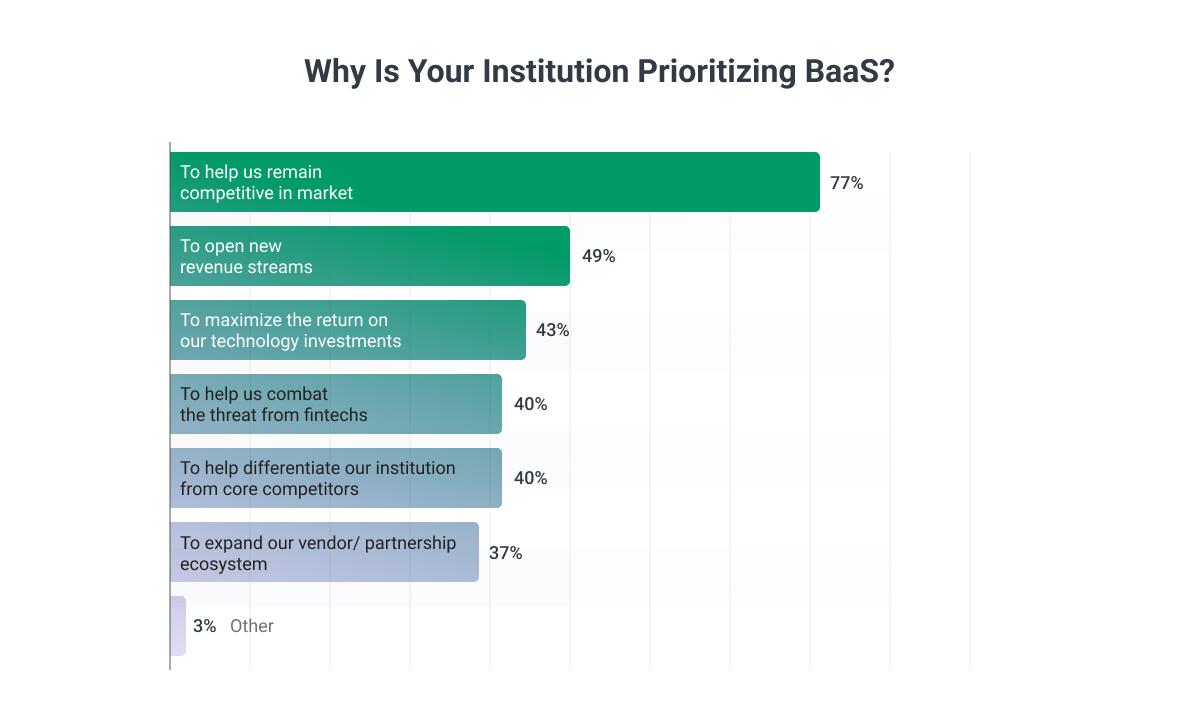

APIs to Drive Banking-as-a-Service Growth

Banking as a service (BaaS) is a model in which traditional banks partner with fintech companies to provide banking services through APIs. This will allow fintech companies to offer their customers access to a wide range of banking services, such as account opening, money transfer, and credit card issuance, without having to build and maintain their own banking infrastructure.

Mobile banking continues to gain momentum in the United States, with 79% adoption projected by 2029, according to recent data from MarketWatch.

The convenience and accessibility of mobile banking have reshaped consumer preferences, with nearly 75% of individuals now favoring mobile and online banking over in-person visits. As Gen-Z and millennials take over the banking market in the coming years, it will be essential for banks to integrate mobile services if they plan to stay competitive.

BaaS can help fintech companies quickly and easily expand their services, and can also benefit banks by providing them with a new source of revenue and a way to reach new customers. We expect BaaS to become increasingly popular as more fintech companies look for ways to offer their customers a wider range of financial services.

Some of the benefits of banking as a service (BaaS) include:

- It allows fintech companies to quickly and easily offer their customers access to a range of banking services, such as account opening, money transfer, and credit card issuance, without having to build and maintain their own banking infrastructure.

- It can help fintech companies to expand their services and reach new customers more quickly and easily.

- It can provide traditional banks with a new source of revenue and a way to reach new customers.

- It can enable fintech companies to offer their customers a more comprehensive suite of financial services, which can increase customer loyalty and retention.

- It can provide a more seamless and convenient experience for customers, who can access all of their financial services from a single platform.

Action Item

To offer banking as a service (BaaS), a fintech company will typically need to partner with a traditional bank that has the necessary infrastructure and regulatory licenses to provide banking services. The fintech company can then use the bank's APIs to access and offer these services to its customers.

The fintech company may also need to integrate its systems with those of the bank in order to enable smooth and secure transactions. Additionally, the fintech company will need to comply with relevant regulations and ensure that it has the necessary security measures in place to protect customer data and transactions. Softjourn has helped multiple clients remove the burden of complicated integrations - reach out to us for a stress-free integration solution.

The Gig Economy and Digital Payments

As the gig economy continues to grow—projected to include over 86 million workers in the U.S. by 2027—it is reshaping the financial landscape, particularly in payments. Gig workers, often operating across multiple platforms, require flexible, real-time payment solutions that adapt to their unique needs. Fintech innovations like digital wallets, instant payouts, and income-smoothing tools have become essential for providing financial stability to this workforce.

For instance, Earned Wage Access (EWA) platforms allow gig workers to access their earnings as soon as they are made, bypassing traditional pay cycles. Additionally, open banking tools and financial aggregation platforms enable gig workers to consolidate their income streams for better financial management. With these tailored solutions, fintech is not only addressing immediate challenges but also empowering gig workers with tools to build long-term financial security.

As the gig economy continues to thrive, businesses that cater to this demographic with innovative payment solutions will be well-positioned to drive adoption and loyalty in this rapidly evolving market.

Companies Will Continue to Optimize Business Expenses

2025 will continue to be marked by economic uncertainty and global challenges. The after-effects of the pandemic linger, compounded by ongoing geopolitical tensions like Russia’s war in Ukraine, economic fluctuations, and shifting political dynamics. Layoffs across major tech companies, including those in FAANG, Twitter, and beyond, highlight the evolving landscape for businesses.

In such turbulent times, it’s easy for business leaders to default to short-term decisions that can derail long-term growth strategies. This often includes drastic cuts in investments in technology, innovation, talent acquisition, workplace modernization, and customer experience—areas critical for maintaining competitive advantage.

While it’s prudent to manage cash flow carefully and control spending, it’s equally vital to make calculated investments in technology and talent that yield long-term value. For fintechs, this means reacting thoughtfully to economic changes rather than making reactive cost-cutting decisions that may harm future prospects. Strategic hiring and adopting technologies with proven ROI can position fintechs to weather challenges while building a foundation for sustainable growth.

Many of the top companies in the world – from big tech companies like Google and Apple to massive players in the Fintech Industry like Visa and Mastercard – rely on a software development partner to secure global technical talent, improve the quality of services, and reduce costs.

If you want to save time and money, focus on your core competencies, access a global talent pool, and gain invaluable fintech and payments-focused consulting services, consider hiring Softjourn's skilled R&D teams in 2025.

Our expert developers and analysts have extensive experience in the financial technology sector, enabling us to provide cutting-edge solutions tailored to your specific needs. From developing secure payment gateways and mobile banking apps to implementing blockchain technologies and conducting in-depth market research, we have the expertise and resources to handle various tech tasks.

Our fintech consulting services will help you navigate the complex landscape of digital payments, ensuring that your business stays ahead of the curve in an increasingly competitive market. By partnering with Softjourn, you'll benefit from our team's deep understanding of the latest industry trends, regulatory requirements, and customer expectations. We'll work closely with you to identify areas for improvement, optimize your processes, and develop innovative solutions that drive growth and enhance customer satisfaction.

Utilizing outsourced technology can help you achieve high-quality results while freeing up your internal resources to focus on your core business objectives. Contact us today to learn more about how our fintech consulting services and skilled R&D teams can help your business succeed in 2025 and beyond.

Final Word

In 2025, the payments landscape will focus on making transactions as seamless and frictionless as possible, both online and in-person. Key trends like blockchain, mobile payments, cashless solutions, and AI-driven fraud detection are reshaping the future of payment processing.

As innovation accelerates and competition intensifies, businesses must adapt quickly to meet evolving consumer demands or risk falling behind. The future of payments promises to be more efficient, consumer-centric, and transformative than ever.

Payments Industry Updates

New EU Consumer Credit Rules to Reshape BNPL Landscape by 2026

The EU’s revised Consumer Credit Directive (CCD2), set for full implementation by late 2026, introduces stricter regulations for Buy Now, Pay Later (BNPL) services. BNPL providers must comply with local APR caps, conduct creditworthiness checks, and clearly communicate loan terms and risks.

The directive will pressure BNPL firms to adapt their pricing and business models to meet compliance across multiple countries. While these rules aim to boost consumer protection and reduce debt, they may also limit access to BNPL and raise operational costs.

[Source: Consultancy.eu, April 2025]

Retail FinTech VC Funding Drops in Q1 2025

Venture Capital investment in retail fintech fell nearly 38% in Q1 2025, totaling $1.9B, as concerns over tariffs, inflation, and IPO slowdowns outweighed optimism around AI and regulatory easing.

Seed-stage funding and valuations saw steep declines, while growth-stage deals remained afloat thanks to outliers like Klarna’s $12B valuation. With ongoing market uncertainty, restrained funding is expected to continue through mid-2025.

[Source: PitchBook via PYMNTS, May 2025]

CFPB Pauses Enforcement of BNPL Rule

The Consumer Financial Protection Bureau announced it will not prioritize enforcement of its Buy Now, Pay Later rule under Regulation Z. Instead, the agency will shift focus to more urgent consumer protection issues - particularly those affecting servicemembers, veterans, and small businesses. The Bureau is also considering rescinding the BNPL rule entirely.

[Source: Consumer Financial Protection Bureau, May 2025]

![[Case Study] UPC: Adding Buy Now Pay Later to Meet Growing Consumer Demand. UPC can now offer buy now pay later to its clients, providing yet another way for all involved in the financial ecosystem to interact and exchange goods and services.](https://softjourn.com/media/expertise/finance/Clients/UPC.svg)